By FXEmpire.com

Silver Fundamental Analysis April 11, 2012, Forecast

Analysis and Recommendations:

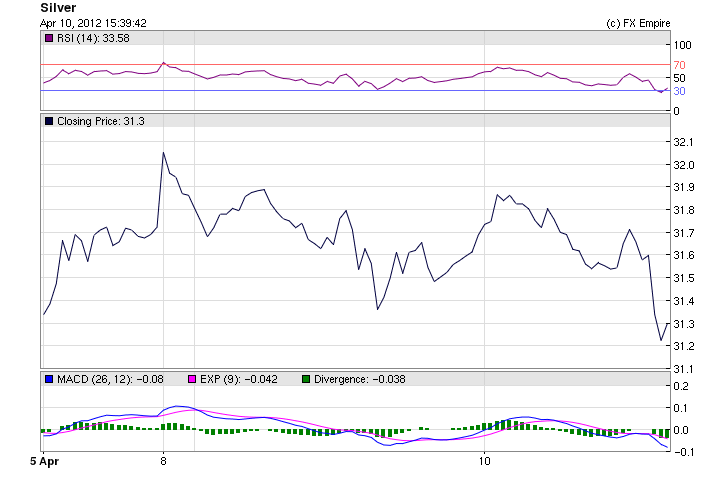

Silver is trading at 31.618 tracking gold as investors moved to the safety of metals and other safe haven currencies.

Investor’s sentiment turned negative today, as equities tumbled and gold, the greenback and the yen traded up. The euro dropped to 1.3097 against the USD.

Anne-Laure Tremblay, precious-metals strategist at BNP Paribas, forecast silver, platinum and palladium will trade higher in line with gold through 2012 and 2013.

“Silver is in large supply surplus, but should follow gold higher, given its strong positive correlation with the metal, although the downside risks here are particularly pronounced,” Tremblay wrote in a research report.

Economic Data for April 10, 2012 actual v. forecast

|

GBP |

RICS House Price Balance |

-10% |

-12% |

-13% |

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

AUD |

NAB Business Confidence |

3 |

1 |

|

|

CNY |

Chinese Trade Balance |

5.3B |

-1.3B |

-31.5B |

|

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

CHF |

Unemployment Rate |

3.1% |

3.1% |

3.1% |

|

DKK |

Danish CPI (YoY) |

2.70% |

2.70% |

2.80% |

|

JPY |

BoJ Press Conference |

|||

|

NOK |

Norwegian Core Inflation (MoM) |

0.40% |

0.30% |

0.70% |

|

NOK |

Norwegian CPI (MoM) |

-0.10% |

-0.10% |

1.00% |

Economic Events for April, 11, 2012

02:30 AUD Home Loans (MoM) -3.5% -1.2%

Home Loans record the change in the number of new loans granted for owner-occupied homes. It is a leading indicator of demand in the housing market.

13:15 CAD Housing Starts 200K 201K

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

13:30 USD Import Price Index (MoM) 0.8% 0.4%

The Import Price Index measures the change in the price of imported goods and services purchased domestically.

19:00 USD Federal Budget Balance -201.5B -232.0B

The Federal Budget Balance measures the difference in value between the federal government’s income and expenditure during the reported month. A positive number indicates a budget surplus; a negative number indicates a deficit.

Government Bond Auctions April 10-20, 2012

Apr 11 09:10 Italy BOT auction

Apr 11 09:30 Germany Eur 5.0bn new Jul 2022 Bund

Apr 11 09:10 Sweden Sek 5.0bn Jul 2012 & Sek 5.0bn Sep 2012 T-bills

Apr 11 09:30 Swiss Bond auction

Apr 11 09:30 UK Gbp 4.5bn 1.0% Sep 2017 Conventional Gilt

Apr 11 10:00 Norway Details T-bill auction on Apr 16

Apr 11 14:30 Sweden Details nominal bond auction on Apr 18

Apr 11 17:00 US Auctions 10Y Notes

Apr 12 09:10 Italy BTP/CCTeu auction

Apr 12 09:30 UK Gbp 2.0bn 4.25% Jun 2032 Conventional Gilt

Apr 12 15:00 US Announces auction of 5Y TIPS on Apr 19

Apr 12 17:00 US Auctions 30Y Bonds

Apr 13 10:00 Belgium OLO mini bond auction

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:

Originally posted here