By FXEmpire.com

The Light Sweet Crude market fell during the session on Tuesday as the all too familiar global fears came back into the markets. The Spanish and Italian bond yields continue to rise, and there are reports of massive borrowing by Portuguese and Spanish banks from the LTRO at the ECB. In other words, it may just be the ECB that is keeping many banks afloat at the moment.

The weakening of the European Union will have a ripple effect across the world, and will continue to keep demand for oil down. In fact, the demand in industrialized nations is considerably down at this point, and as a result the oil markets have been grinding lower lately.

The concerns are that the emerging markets are going to slow down on the consumption side as well, as the West will stop buying as much of their exports. With this being said, there is only one reason why there is a bid in the market currently: Iran.

The Iranian situation continues to drag along in the news, and these headlines can cause a spike here and there. However, there has to be a point where the markets get “tired” of hearing about the Iranians and the situation surrounding their nuclear enrichment program. It is possible that we are starting to enter that phase, as many traders seem to keep the idea of a closing of supply in the back of their mind – but not an upfront fear like a few weeks ago.

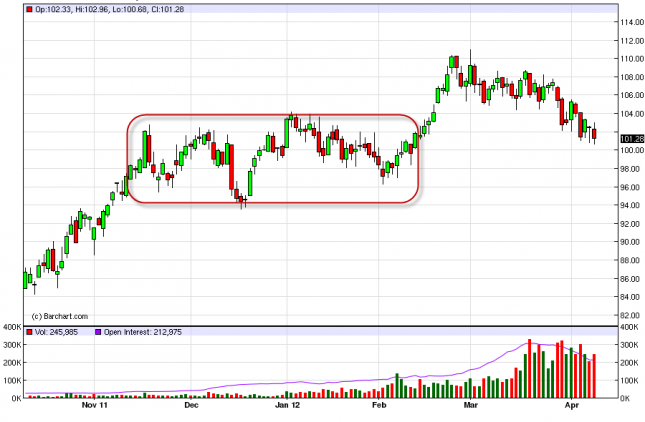

The wildcard is of course if there is any kind of intervention in the Middle East by the Israelis. The slight possibility seems to be what most analysts think is pushing the bulls at the moment. If the global economy continues to grind lower – this commodity goes down in value as demand will simply fall off of a cliff. With this in mind, we see a lot of support just below as indicated by the congestion previously and in the levels below down to the $95 level. With all of this being said, we are looking for support to buy – but just haven’t found it yet. We may not actually, but there is far too much noise until we clear $95 to sell.

Oil Forecast April 11, 2012, Technical Analysis

Originally posted here