By FXEmpire.com

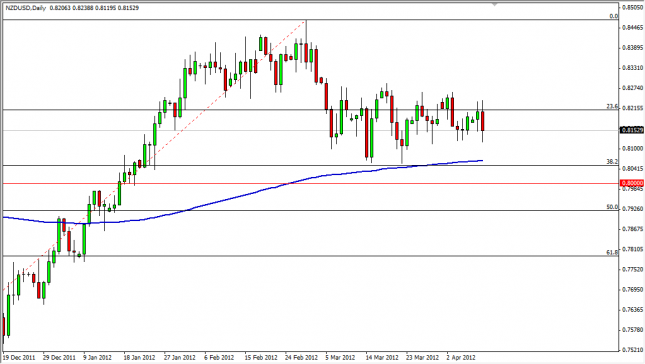

NZD/USD fell during the session on Tuesday as the “risk off” trade came back into play. The European markets sold off after reports of massive bank borrowing in the EU to support them. The yields in Portugal, Spain, and Italy are all rising, and this will spook the markets in general. The 200 day EMA is just below, so it appears that we will find support. Also, the 0.80 and 0.81 levels look supportive too.

The market isn’t one we can sell until we get below the 50% Fibonacci retracement level, which is down at the 0.7950 level or so. The bounce at the end of the session suggests that this pair will go sideways for the time being, and as a result we are currently flat. A buy in this pair isn’t possible until we got a close above the 0.8250 level.

NZD/USD Forecast April 11, 2012, Technical Analysis

Originally posted here