By FXEmpire.com

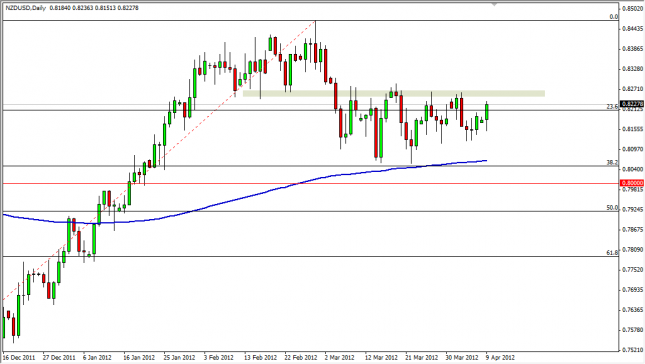

The Kiwi dollar has a bullish session on Monday as the pair continues its slow grind higher. The pair is sitting just above the 200 day EMA, and the 0.80 level is below that as well. The 38.2% Fibonacci level is sitting at the 200 day EMA as well, so this looks like a massive support level. The 50% Fibonacci level is below the 0.80 level, so even a break of that area wouldn’t have us selling.

Because of this, there really is only one direction to trade this pair, and that is long. The 0.8250 level above is the bottom of the previous resistance area, and is acting as resistance currently. With that in mind, we are bullish, but prefer to buy on pullbacks as this pair seems range bound for the moment. Selling won’t be done until we break below the aforementioned 0.7950 level. (The 50% Fibonacci level)

NZD/USD Forecast April 10, 2012, Technical Analysis

Originally posted here