By FXEmpire.com

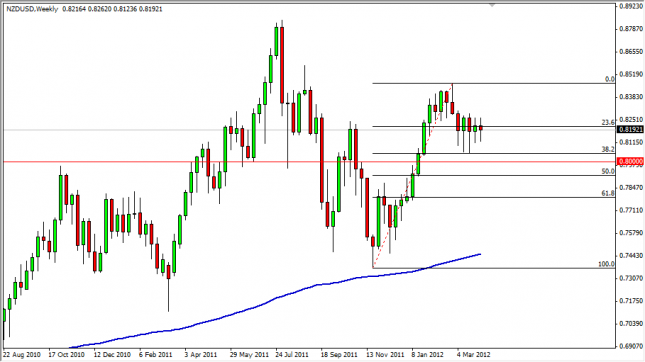

The NZD/USD pair fell for most of the previous week, sending the pair to wonder within the recent range. The 0.82 level seems to be the magnet for prices lately, and the action has been fairly tight. However, one cannot help but notice the last 5 weekly candles are all either hammers or dojis – looking very supportive indeed.

The trend is up since late last year, so this shouldn’t be a surprise. Besides, we have several reasons to think that the support should hold including the following: The 0.80 level is the most obvious level to find buyers, as it is a major round number and they always attract traders. Adding to that is the 200 EMA on the daily chart is just below the current price action, and the 38.2% Fibonacci level is acting as support as well. With all of this adding up below, it is hard to think that this pair will fall without a serious fight. Because of this, we are bullish of this pair over the long term.

The recent market has been very sideways, but when looking at the move previously – it makes sense as the move up to this level was so strong. When we see moves like this, either a pullback will happen, or a sideways move like we have been having lately. Because of this, we think the uptrend is still intact – but simply taking a breather.

The Kiwi dollar continues to be sensitive to commodity markets, and the general sentiment will have to be watched in order to get a read on this market. However, the swap is positive in this pair – so traders who are long at the moment are being paid to wait. The overall momentum seems to be waning, but if there is any real hint of new quantitative easing out of the Fed, this pair will gain in value. If not, and there is strength going forward in the US economy, this pair should also gain as the commodity markets continue to rise. Either way, we are long of this pair, and will need to see the 79.50 level broken on a daily close to be convinced that the pair is changing trends.

NZD/USD Forecast for the Week of April 9, 2012, Technical Analysis

Originally posted here