By FXEmpire.com

The USD/JPY pair fell hard at the end of the week as the Non-Farm Payroll number came out 80,000 less jobs added than expected. The pair has recently been very bullish, and this could be a bit of a setback. However, when looking at the overall picture, we still have a Bank of Japan that is very dovish, and there are serious signs of growth in the United States as well. The economic picture is much stronger in the US, and although there aren’t necessarily signs of interest rate hikes – it certainly is coming much soon than in Japan.

The Japanese demographic is changing rapidly as the population ages. The government in Japan has been extraordinarily lucky in the sense that the population has been buying bonds in droves as they plan for retirement. However, the population is aging, and it will be difficult to replace this group of people as foreigners don’t typically buy many of the Japanese Government Bonds.

This is a problem that Japan is going to have to come to terms with, and the Bank of Japan’s recent announcement that they were going to be buying much more in the bond market than before is the first step in cranking up the printing press and flooding the markets with Yen. Simple supply and demand should continue to drive down the demand for Yen overall.

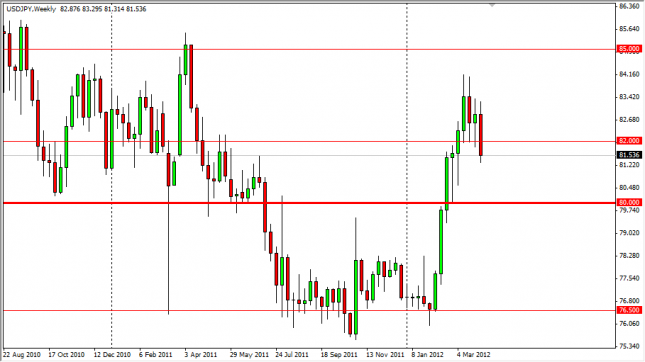

The market of course fell on the reaction to labor reports, but the overall trend has been broken to the upside with great momentum. The reaction was predictable, but the overall move has been so strong – it is hard to think that the move will suddenly be negated. When trends change, it is often a messy affair, with many whipsaws. This shouldn’t be any different, and as such we will continue to look at the long-term picture for our trades. The market is to be bought on dips, and as such we are already looking to buy this pair again. The first sign of support on the daily chart signals a chance to buy. 80 is our “floor”, and if it gets broken we would have to look at the market again, and decide if the downtrend was back in play.

USD/JPY Forecast for the Week of April 9, 2012, Technical Analysis

Originally posted here