By FXEmpire.com

Gold Fundamental Analysis April 9, 2012, Forecast

Analysis and Recommendations:

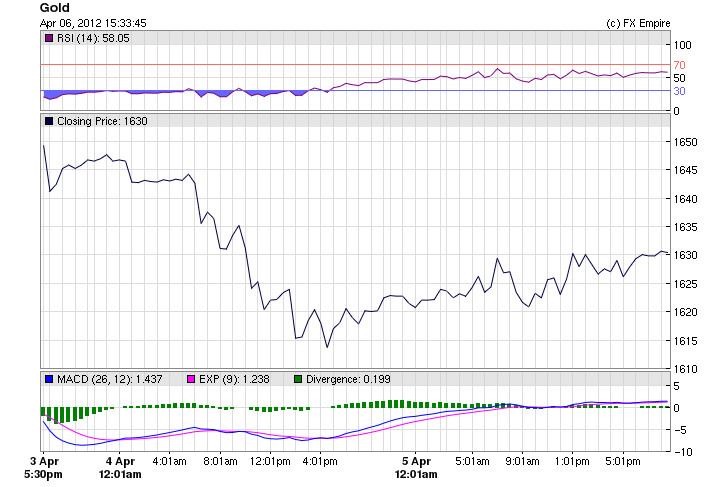

Gold futures rebounded as bargain hunters honed in after dashed expectations of further U.S. monetary stimulus prompted a sharp decline for both metals in the previous session.

Gold climbed $16, or 1%, to end at $1,630.10 an ounce on the Comex division of the New York Mercantile Exchange.

The gains were not enough to erase weekly losses of 2.5% for gold. Commodity markets were closed Friday in observance of Good Friday.

It is a very quiet day, with global markets closed for the holiday weekend.

The Non Farms Payroll data showed for the first time since November that job growth dropped below the 200,000 level. Economists expected a rise of 210,000. The unemployment rate fell to 8.2% from 8.3%, mostly because more people dropped out of the work force.

In the forex markets, the dollar fell against other major currencies, posting a particularly steep drop against the Japanese yen, which tends to be seen as a safe-haven currency.

Economic Reports for April 6, 2012 actual v. forecast

|

Apr. 06 |

JPY |

Leading Index |

96.6 |

95.6 |

94.5 |

|

EUR |

French Government Budget Balance |

-24.2B |

-12.5B |

||

|

EUR |

French Trade Balance |

-6.4B |

-5.2B |

-5.6B |

|

|

HUF |

Hungarian Industrial Output (YoY) |

1.10% |

-1.00% |

-0.50% |

|

|

USD |

Average Hourly Earnings (MoM) |

0.2% |

0.2% |

0.3% |

|

|

USD |

Nonfarm Payrolls |

120K |

203K |

240K |

|

|

USD |

Unemployment Rate |

8.2% |

8.3% |

8.3% |

|

|

USD |

Average Weekly Hours |

34.5 |

34.5 |

34.6 |

|

|

USD |

Private Nonfarm Payrolls |

121K |

218K |

233K |

|

|

USD |

ECRI Weekly Annualized (WoW) |

1.00% |

-0.40% |

Economic Events scheduled for April 9, 2012

02:30 CNY Chinese CPI (YoY) 3.3% 3.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

02:30 CNY Chinese PPI (YoY) -0.2%

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

10:00 EUR Greek CPI (YoY) 2.10%

Consumer Price index is the most frequently used indicator of inflation and reflect changes in the cost of acquiring a fixed basket of goods and services by the average consumer.

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Originally posted here