By FXEmpire.com

EUR/USD Weekly Fundamental Analysis April 9-13, 2012, Forecast

Introduction: Out of the major currency pairs the most popular and easy to trade currency pair is the EUR/USD. It has become so popular with traders these days that even when there is no visible trade to be had it is yet traded as a matter of habit. This is of course something that should be avoided and any investor who trades this currency pair wisely can do so successfully with sizable profits at the end of the day.

The first thing with trading currencies is to realize that the EUR/USD is made up of two separate currencies although considered to be one unit when taken as a pair. The weaknesses and strengths of each currency have to be taken into consideration when trading the unit as it influences the final outcome. Another factor that is often overlooked by traders or investors is that the weakening of one currency along with the strengthening of the other currency in the pair results in the generation of pips. It is according to this that entry and exit from the Forex market has to be done in order to maintain profitability.

- The interest rate differential between the European Bank(ECB) and the Federal Reserve(FED)

- Dollar strength drives EUR/USD lower

- FED intervention to weaken the dollar the sends EUR/USD higher

Analysis and Recommendation:

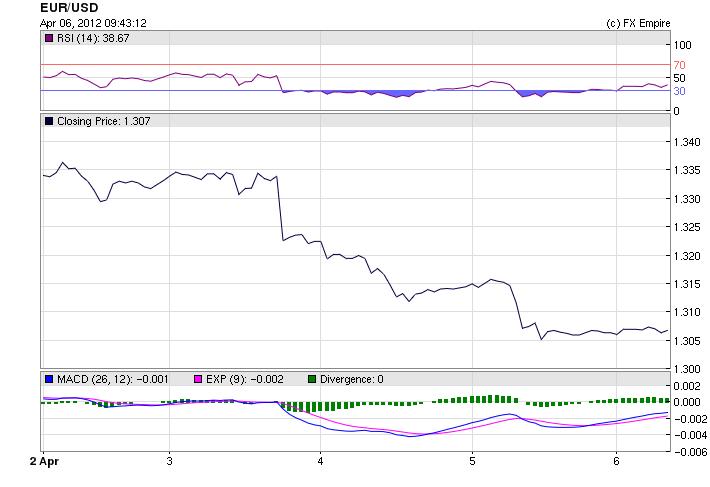

The EUR/USD began to tumble all week. Starting the week at 1.3357 the euro closed at 1.3065. Continued worries about Spain and Italy, overshadowed the EU Finance Ministers approval of the new firewall limits.

Disappointing economic data flowed all week. Spain introduced a tough new budget, which incorporated all the austerity measures demanded by the EU, but in reality would be difficult or impossible to implement.

Greece continued in the headlines, as worried about the necessity of a 3rd bailout became news.

Midweek, the US FOMC minutes were released throwing markets into turmoil. It was clear by the minutes that the FED has no plans of any additional monetary easing in any form. This made investors rethink values.

The US offered up many positive reports this week, supported by the Treasury and the Fed speeches. Some data was under forecast but all supported economic growth.

On Friday was the release of the NFP which was a surprising report, the creation of jobs fell well below forecast but unemployment fell also, which can only mean one of two things, there was just a blip in the data, or that people were remaining unemployed but their benefits had ceased.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/06/2012 |

1.3065 |

1.3063 |

1.3078 |

1.3054 |

0.02% |

|

04/05/2012 |

1.3063 |

1.3144 |

1.3164 |

1.3036 |

-0.62% |

|

04/04/2012 |

1.3144 |

1.3223 |

1.3233 |

1.3108 |

-0.60% |

|

04/03/2012 |

1.3223 |

1.3330 |

1.3368 |

1.3214 |

-0.80% |

|

04/02/2012 |

1.3328 |

1.3357 |

1.3380 |

1.3279 |

-0.22% |

|

04/01/2012 |

1.3357 |

1.3361 |

1.3377 |

1.3356 |

-0.03% |

Economic Data from Europe for the week of April 2-6, 2012 actual v. forecast

|

Apr. 02 |

08:15 |

CHF |

Retail Sales (YoY) |

0.8% |

3.2% |

4.7% |

|

08:30 |

CHF |

SVME PMI |

51.1 |

49.5 |

49.0 |

|

|

08:50 |

EUR |

French Manufacturing PMI |

46.7 |

47.6 |

47.6 |

|

|

08:55 |

EUR |

German Manufacturing PMI |

48.4 |

48.1 |

48.1 |

|

|

09:00 |

EUR |

Manufacturing PMI |

47.7 |

47.7 |

47.7 |

|

|

09:30 |

GBP |

Manufacturing PMI |

52.1 |

50.5 |

51.5 |

|

|

10:00 |

EUR |

Unemployment Rate |

10.8% |

10.8% |

10.7% |

|

|

Apr. 03 |

10:00 |

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

|

Apr. 04 |

08:00 |

GBP |

Halifax House Price Index (MoM) |

2.2% |

-0.3% |

-0.4% |

|

09:30 |

GBP |

Services PMI |

55.3 |

53.5 |

53.8 |

|

|

10:00 |

EUR |

Retail Sales (MoM) |

-0.1% |

0.1% |

1.1% |

|

|

11:00 |

EUR |

German Factory Orders (MoM) |

0.3% |

1.2% |

-1.8% |

|

|

12:45 |

EUR |

1.00% |

1.00% |

1.00% |

||

|

13:30 |

EUR |

ECB Press Conference |

||||

|

Apr. 05 |

08:15 |

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

08:30 |

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

|

09:30 |

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

|

09:30 |

GBP |

Manufacturing Production (MoM) |

-1.0% |

0.1% |

-0.3% |

|

|

12:00 |

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

|

12:00 |

GBP |

BOE QE Total |

325B |

325B |

325B |

|

|

15:00 |

GBP |

NIESR GDP Estimate |

0.1% |

0.0% |

Economic Data from the US for the week of April 2-6, 2012 actual v. forecast

|

Apr. 02 |

USD |

ISM Manufacturing Index |

53.4 |

53.0 |

52.4 |

|

Apr. 03 |

USD |

FOMC Meeting Minutes |

|||

|

Apr. 04 |

USD |

ADP Nonfarm Employment Change |

209K |

200K |

230K |

|

Apr. 05 |

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

Apr. 06 |

USD |

Nonfarm Payrolls |

120K |

203K |

240K |

|

USD |

Unemployment Rate |

8.2% |

8.3% |

8.3% |

Historical:

Highest: 1.5091 USD on 03 Dec 2009.

Average: 1.3709 USD over this period.

Lowest: 1.19 USD on 07 Jun 2010.

Economic Events: (GMT)

Economic Highlights of the coming week for the USA (only minor reports, a very light week)

|

Apr. 9 |

15:00 |

USD |

CB Employment Trends Index |

107.50 |

|

Apr 10 |

12:30 |

USD |

NFIB Small Business Optimism |

94.3 |

|

13:55 |

USD |

Redbook (MoM) |

0.70% |

|

|

15:00 |

USD |

Wholesale Inventories (MoM) |

0.5% |

0.4% |

|

15:00 |

USD |

IBD/TIPP Economic Optimism |

47.5 |

|

|

21:30 |

USD |

API Weekly Crude Stock |

7.85M |

|

|

21:30 |

USD |

API Weekly Gasoline Stock |

-4.46M |

Economic Highlights of the coming week that affect the Euro, the USD and the Franc

|

Apr. 10 |

00:01 |

GBP |

RICS House Price Balance |

-13% |

|

06:45 |

CHF |

Unemployment Rate |

3.1% |

|

|

Apr. 12 |

06:30 |

EUR |

French CPI (MoM) |

0.4% |

|

08:30 |

EUR |

Dutch Retail Sales (YoY) |

0.80% |

|

|

09:30 |

GBP |

Trade Balance |

-7.5B |

|

|

10:00 |

EUR |

Industrial Production (MoM) |

0.2% |

|

|

10:00 |

EUR |

Portuguese CPI (MoM) |

0.10% |

|

|

10:00 |

EUR |

Greek Unemployment Rate |

21.00% |

|

|

Apr. 13 |

07:00 |

EUR |

German CPI (MoM) |

0.3% |

|

07:00 |

EUR |

Finnish CPI (YoY) |

3.10% |

|

|

09:30 |

GBP |

PPI Input (MoM) |

2.1% |

Originally posted here