By FXEmpire.com

EUR/GBP Weekly Fundamental Analysis April 9-13, 2012, Forecast

Introduction: The cross tends to move in ranges, with relatively clear barriers. The narrower ranges made it somewhat harder, but it seems to return to wider ranges. The GBP is does not seem to move in response to the EUR as directly currently. The UK austerity program vs. The EU debt crisis seems to have them moving in opposing distances. They are developing new trading personalities and there is a good deal of profit to be made trading this pair. They can be volatile.

- The interest rate differential between the European Bank(ECB) and the Bank of England(BoE)

- European and UK economic data

- Growth differentials between the Euro zone and UK

Analysis and Recommendations

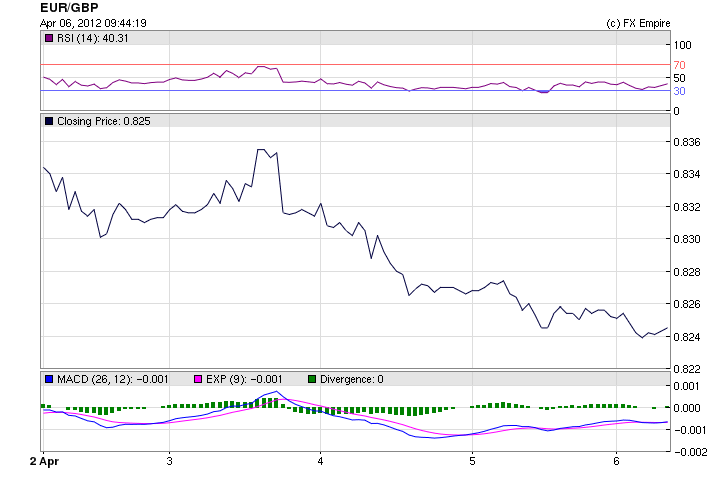

The EUR/GBP ended the week at 0.8241.

The sterling had several strong reports over the past week but they were mixed with several negatives also, PMI and Service PMI and Housing were over forecast. The BoE maintained interest rates. It was just a mixed bag

Whereas the euro began to tumble mid week on continued worries about Spain and Italy, overshadowed the EU Finance Ministers approval of the new firewall limits.

Disappointing economic data flowed all week. Spain introduced a tough new budget, which incorporated all the austerity measures demanded by the EU, but in reality would be difficult or impossible to implement.

Greece continued in the headlines, as worried about the necessity of a 3rd bailout became news.

Midweek, the US FOMC minutes were released throwing markets into turmoil. It was clear by the minutes that the FED has no plans of any additional monetary easing in any form. This made investors rethink values.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/06/2012 |

0.8241 |

0.8252 |

0.8256 |

0.8237 |

-0.13% |

|

04/05/2012 |

0.8252 |

0.8266 |

0.8280 |

0.8238 |

-0.17% |

|

04/04/2012 |

0.8265 |

0.8314 |

0.8325 |

0.8262 |

-0.59% |

|

04/03/2012 |

0.8314 |

0.8313 |

0.8358 |

0.8313 |

0.01% |

|

04/02/2012 |

0.8312 |

0.8342 |

0.8349 |

0.8294 |

-0.36% |

|

04/01/2012 |

0.8342 |

0.8338 |

0.8350 |

0.8336 |

0.05% |

Economic Data from Europe for the week of April 2-6, 2012 actual v. forecast

|

Apr. 02 |

08:15 |

CHF |

Retail Sales (YoY) |

0.8% |

3.2% |

4.7% |

|

08:30 |

CHF |

SVME PMI |

51.1 |

49.5 |

49.0 |

|

|

08:50 |

EUR |

French Manufacturing PMI |

46.7 |

47.6 |

47.6 |

|

|

08:55 |

EUR |

German Manufacturing PMI |

48.4 |

48.1 |

48.1 |

|

|

09:00 |

EUR |

Manufacturing PMI |

47.7 |

47.7 |

47.7 |

|

|

09:30 |

GBP |

Manufacturing PMI |

52.1 |

50.5 |

51.5 |

|

|

10:00 |

EUR |

Unemployment Rate |

10.8% |

10.8% |

10.7% |

|

|

Apr. 03 |

10:00 |

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

|

Apr. 04 |

08:00 |

GBP |

Halifax House Price Index (MoM) |

2.2% |

-0.3% |

-0.4% |

|

09:30 |

GBP |

Services PMI |

55.3 |

53.5 |

53.8 |

|

|

10:00 |

EUR |

Retail Sales (MoM) |

-0.1% |

0.1% |

1.1% |

|

|

11:00 |

EUR |

German Factory Orders (MoM) |

0.3% |

1.2% |

-1.8% |

|

|

12:45 |

EUR |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

|

13:30 |

EUR |

ECB Press Conference |

||||

|

Apr. 05 |

08:15 |

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

08:30 |

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

|

09:30 |

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

|

09:30 |

GBP |

Manufacturing Production (MoM) |

-1.0% |

0.1% |

-0.3% |

|

|

12:00 |

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

|

12:00 |

GBP |

BOE QE Total |

325B |

325B |

325B |

|

|

15:00 |

GBP |

NIESR GDP Estimate |

0.1% |

0.0% |

Historical:

Highest: 1.2336 EUR on 29 Jun 2010.

Average: 1.1548 EUR over this period.

Lowest: 1.0686 EUR on 13 Oct 2009

Economic Events:

Economic Highlights of the coming week that affect the Euro, the USD and the Franc

|

Apr. 10 |

00:01 |

GBP |

RICS House Price Balance |

-13% |

|

06:45 |

CHF |

Unemployment Rate |

3.1% |

|

|

Apr. 12 |

06:30 |

EUR |

French CPI (MoM) |

0.4% |

|

08:30 |

EUR |

Dutch Retail Sales (YoY) |

0.80% |

|

|

09:30 |

GBP |

Trade Balance |

-7.5B |

|

|

10:00 |

EUR |

Industrial Production (MoM) |

0.2% |

|

|

10:00 |

EUR |

Portuguese CPI (MoM) |

0.10% |

|

|

10:00 |

EUR |

Greek Unemployment Rate |

21.00% |

|

|

Apr. 13 |

07:00 |

EUR |

German CPI (MoM) |

0.3% |

|

07:00 |

EUR |

Finnish CPI (YoY) |

3.10% |

|

|

09:30 |

GBP |

PPI Input (MoM) |

2.1% |

Originally posted here