By FXEmpire.com

Introduction: In the USD/JPY trade, trying to pick tops or bottoms during that time would have been difficult. However, with the bull trend so dominant, the far easier and smarter trade was to look for technical opportunities to go with the fundamental theme and trade with the market trend rather than to trying to fade it.

USD/JPY Weekly Fundamental Analysis April 9-13, 2012, Forecast

Against the Japanese yen, whose central bank held rates steady at zero, the dollar appreciated 19% from its lowest to highest levels. USD/JPY was in a very strong uptrend throughout the year, but even so, there were plenty of retraces along the way. These pullbacks were perfect opportunities for traders to combine technicals with fundamentals to enter the trade at an opportune moment.

- The interest rate differential between the Bank of Japan(BoJ) and the Federal Reserve

- Japanese government intervention to maintain their currency sends USD/JPY lower

Analysis and Recommendation:

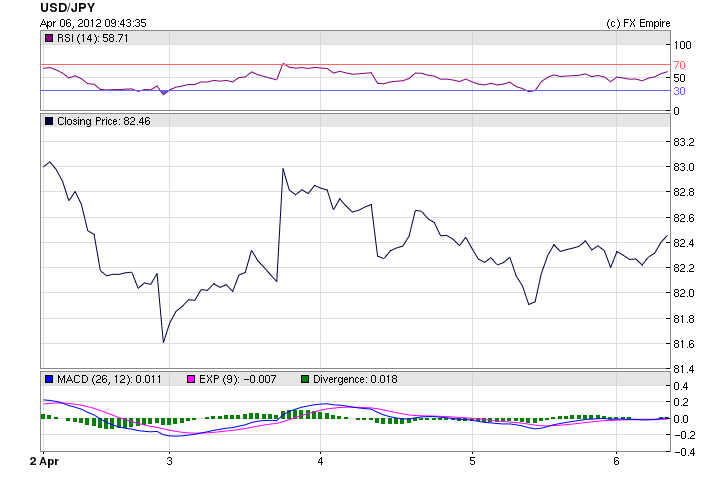

The USD/JPY had a tough battle this week, ranging from 81.56 to a weekly high of 83.30, the pair mostly stayed in a range between the upper 82.00 price and the high 81.00 price.

The Tankan Survey was disappointing in terms of sentiment of the large manufacturers and their capital expenditure plans. Nevertheless, the large manufacturers are looking for a stronger yen. They expect the dollar-yen to average JPY78.14 during the fiscal year that just began compared with JPY79.02 expectation in the December ’11 survey.

Whereas the USD had strong supporting data all week, until the release of the NFP after markets were closed on Friday.

Chinese markets were closed midweek for a local holiday. But the overall economic slowdown in China has all the Pacific currencies depressed.

With the ongoing problems in Europe as Spain and Italy, as well as France sees increased borrowing costs, sentiment continues to turn negative. The JPY has been the benefactor of some flight to safe havens.

Barring aggressive action by the BOJ next week, we suspect external factors will be more important for the yen than purely domestic considerations. We are concerned that the best part of the liquidity induced easing of tensions in Europe is behind us and that political and economic headline risk in the weeks ahead are on the downside. This would likely support the yen against the dollar, but especially the crosses. The large under performance yen in the first three months is likely to be retraced. The risk is for the dollar to test the JPY80-81 area in the coming weeks.

|

04/06/2012 |

82.45 |

82.22 |

82.49 |

82.16 |

0.28% |

|

04/05/2012 |

82.22 |

82.42 |

82.45 |

81.83 |

-0.25% |

|

04/04/2012 |

82.44 |

82.85 |

82.94 |

82.10 |

-0.50% |

|

04/03/2012 |

82.85 |

81.63 |

82.99 |

81.63 |

1.49% |

|

04/02/2012 |

81.64 |

82.89 |

83.30 |

81.56 |

-1.51% |

|

04/01/2012 |

82.89 |

83.03 |

83.06 |

82.76 |

-0.17% |

Economic Data for the week of April 2-6, 2012 for the Yen, the Aussie and the Kiwi actual v. forecast

|

Apr. 02 |

KRW |

South Korean CPI (YoY) |

2.6% |

3.1% |

3.1% |

|

JPY |

Tankan Large Manufacturers Index |

-4 |

-1 |

-4 |

|

|

AUD |

Building Approvals (MoM) |

-7.8% |

0.3% |

1.1% |

|

|

INR |

Indian Trade Balance |

-15.2B |

-13.0B |

-14.8B |

|

|

Apr. 03 |

AUD |

Retail Sales (MoM) |

0.2% |

0.3% |

0.3% |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

|

AUD |

RBA Rate Statement |

||||

|

Apr. 04 |

AUD |

Trade Balance |

-0.48B |

1.00B |

-0.97B |

Economic Data from the USA for the week of April 2-6, 2012 actual v. forecast

|

Apr. 02 |

USD |

ISM Manufacturing Index |

53.4 |

53.0 |

52.4 |

|

Apr. 03 |

USD |

FOMC Meeting Minutes |

|||

|

Apr. 04 |

USD |

ADP Nonfarm Employment Change |

209K |

200K |

230K |

|

Apr. 05 |

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

Apr. 06 |

USD |

Nonfarm Payrolls |

120K |

203K |

240K |

|

USD |

Unemployment Rate |

8.2% |

8.3% |

8.3% |

Economic Events: (GMT)

Economic Highlights of the coming week for the USA (only minor reports, a very light week)

|

Apr. 9 |

15:00 |

USD |

CB Employment Trends Index |

107.50 |

|

Apr 10 |

12:30 |

USD |

NFIB Small Business Optimism |

94.3 |

|

13:55 |

USD |

Redbook (MoM) |

0.70% |

|

|

15:00 |

USD |

Wholesale Inventories (MoM) |

0.5% |

0.4% |

|

15:00 |

USD |

IBD/TIPP Economic Optimism |

47.5 |

|

|

21:30 |

USD |

API Weekly Crude Stock |

7.85M |

|

|

21:30 |

USD |

API Weekly Gasoline Stock |

-4.46M |

Economic Highlights of the coming week that affect the Yen, the Aussie and the Kiwi.

|

Apr. 10 |

02:30 |

AUD |

NAB Business Confidence |

1 |

|

23:00 |

NZD |

NZIER Business Confidence |

||

|

Apr. 11 |

02:30 |

AUD |

Home Loans (MoM) |

-1.2% |

|

Apr. 12 |

02:30 |

AUD |

Employment Change |

-15.4K |

|

02:30 |

AUD |

Unemployment Rate |

5.2% |

Originally posted here