By FXEmpire.com

EUR/CHF Fundamental Analysis April 6, 2012, Forecast

Analysis and Recommendations:

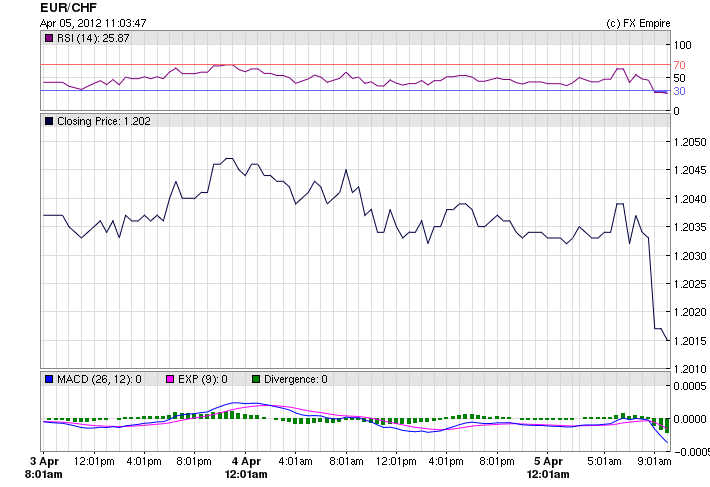

The EUR/CHF is trading at 1.2016 after falling to a new recent low of 1.2000. Renewed worries over Europe’s sovereign debt problems on Thursday prompted a long-awaited showdown between the Swiss National Bank and Swissie bulls, and Switzerland’s central bankers say they’re not about to back down.

The euro fell versus most major rivals Thursday as Spanish and Italian government bond yields continued their recent rise. The shared currency appeared to break through a trading floor of 1.20 Swiss francs set by the Swiss National Bank last September.

Several strategists said the SNB stepped in to buy euros. A spokesman for the central bank declined to comment on whether the institution intervened, but said the SNB was prepared to defend the CHF1.20 floor with “utmost determination” and was prepared to buy currencies in “unlimited quantities.”

The euro traded at 1.2016 francs in recent action, a decline of 0.2% from Wednesday.

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 6, 2012 that affect the European and American Markets

13:30 USD Average Hourly Earnings (MoM)

13:30 USD Private Nonfarm Payrolls

Average Hourly Earnings measures the change in the price businesses pay for labor, not including the agricultural sector. Private Nonfarm Payrolls measures the change in the number of total number of paid U.S. workers of any business, excluding general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals and farm employees.

13:30 USD Nonfarm Payrolls

13:30 USD Unemployment Rate

Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for the majority of economic activity. The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

Government Bond Auctions

None scheduled until after April 10, 2012 due to holiday schedule

Originally posted here