By FXEmpire.com

USD/CAD Fundamental Analysis April 6, 2012, Forecast

Analysis and Recommendations:

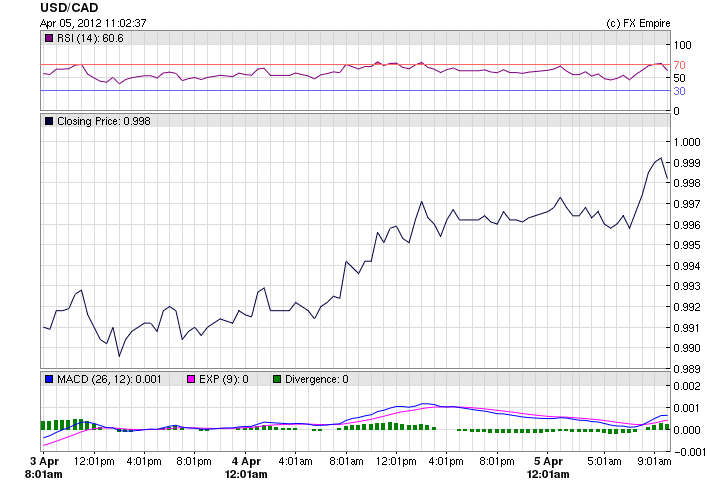

The USD/CAD is trading for 0.9927 after hitting a high of 0.9998. The USD traded higher against all of its trading partners except here, where the greenback was in a tug of war with the Looney. Canada today released surprising figures showing a huge drop in unemployment. The projected rate as 8.0%, the previous rate was 7.4% and the actual was 7.2%. The same was true for employment change, the forecast was 10k and the actual was 82.3k showing a huge amount of jobs were being created. To top that off, building permits which were forecast at 3.0% a significant rise from last month of -11.4% reported in at 7.5%. This provided the needed strength to the CAD to survive negative results from the Ivey PMI which came in under forecast at 63.5 but still positive.

The USD in earlier trading was as high as 0.9998 when the CAD was able to gather strength to push the USD down. In the US unemployment figures were positive also showing the number of Americans who filed requests for jobless benefits fell by 6,000 last week to 357,000, the U.S. Labor Department said Thursday. Economists had projected claims would total 360,000.

On Friday the US will release the Non Farms Payroll reports and this will determine who will end up on top in the employment numbers game.

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

CAD |

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 6, 2012 that affect the European and American Markets

13:30 USD Average Hourly Earnings (MoM)

13:30 USD Private Nonfarm Payrolls

Average Hourly Earnings measures the change in the price businesses pay for labor, not including the agricultural sector. Private Nonfarm Payrolls measures the change in the number of total number of paid U.S. workers of any business, excluding general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals and farm employees.

13:30 USD Nonfarm Payrolls

13:30 USD Unemployment Rate

Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for the majority of economic activity. The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

Government Bond Auctions

None scheduled until after April 10, 2012 due to holiday schedule

Originally posted here