By FXEmpire.com

Silver Fundamental Analysis April 6, 2012, Forecast

Analysis and Recommendations:

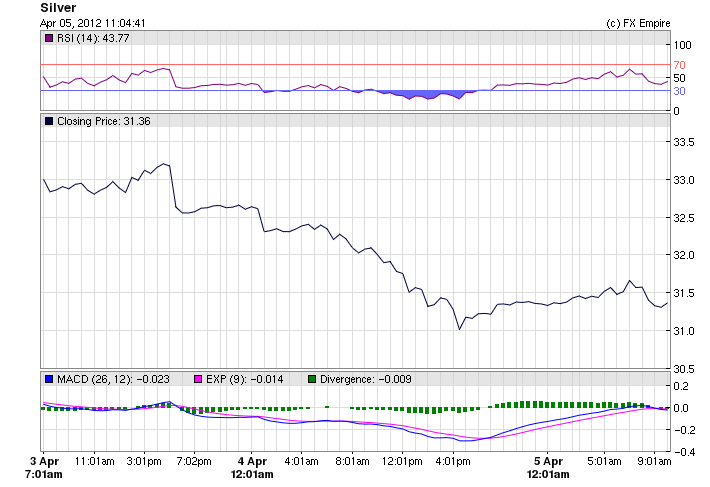

The Silver is trading at 31.663 gaining 0.619 in today’s session.

Silver would likely get a boost in the event of a decisive economic upturn or further monetary easing. Unfortunately, these two outcomes represent scenarios at the extremes of optimism and pessimism about the economy. And the Federal Reserve’s latest minutes dented hopes for more quantitative easing. The current reality of sluggish but persistent economic recovery amid multiple headwinds is less striking–with all that this implies for silver prices.

Silver would likely get a boost in the event of a decisive economic upturn or further monetary easing. Unfortunately, these two outcomes represent scenarios at the extremes of optimism and pessimism about the economy. And the Federal Reserve’s latest minutes dented hopes for more quantitative easing. The current reality of sluggish but persistent economic recovery amid multiple headwinds is less striking–with all that this implies for silver prices.

Economic Events April 5, 2012 actual v. forecast

|

CHF |

CPI (MoM) |

0.6% |

0.4% |

0.3% |

|

EUR |

Dutch CPI (YoY) |

2.50% |

2.20% |

2.50% |

|

GBP |

Industrial Production (MoM) |

0.4% |

0.3% |

-0.6% |

|

GBP |

Manufacturing Production |

-1.0% |

0.1% |

-0.3% |

|

GBP |

Interest Rate Decision |

0.50% |

0.50% |

0.50% |

|

GBP |

BOE QE Total |

325B |

325B |

325B |

|

BRL |

Brazilian CPI (YoY) |

5.2% |

5.4% |

5.8% |

|

Building Permits (MoM) |

7.5% |

3.0% |

-11.4% |

|

|

CAD |

Employment Change |

82.3K |

10.0K |

-2.8K |

|

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

CAD |

Unemployment Rate |

7.2% |

8.0% |

7.4% |

|

USD |

Continuing Jobless Claims |

3338K |

3350K |

3354K |

|

CAD |

Ivey PMI |

63.5 |

66.0 |

66.5 |

|

GBP |

NIESR GDP Estimate |

0.1% |

0.1% |

Economic Events scheduled for April 6, 2012 that affect the European and American Markets

13:30 USD Average Hourly Earnings (MoM)

13:30 USD Private Nonfarm Payrolls

Average Hourly Earnings measures the change in the price businesses pay for labor, not including the agricultural sector. Private Nonfarm Payrolls measures the change in the number of total number of paid U.S. workers of any business, excluding general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals and farm employees.

13:30 USD Nonfarm Payrolls

13:30 USD Unemployment Rate

Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry. Job creation is the foremost indicator of consumer spending, which accounts for the majority of economic activity. The Unemployment Rate measures the percentage of the total work force that is unemployed and actively seeking employment during the previous month.

Government Bond Auctions

None scheduled until after April 10, 2012 due to holiday schedule

Originally posted here