By FXEmpire.com

Crude Oil Fundamental Analysis April 5, 2012, Forecast

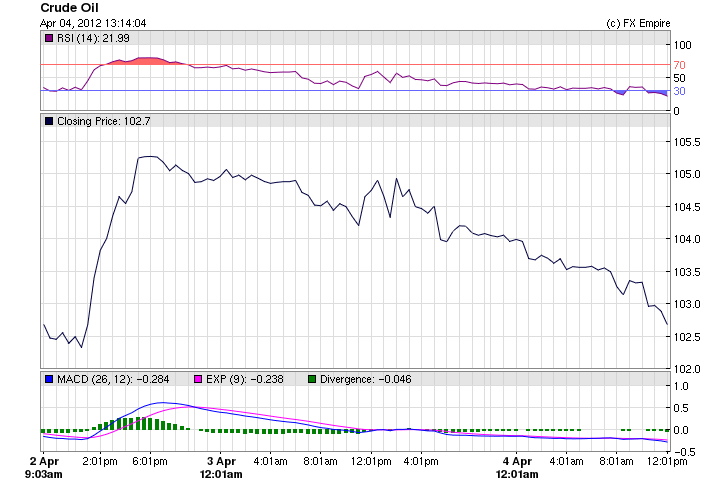

Analysis and Recommendations:

REMEMBER, MOST GLOBAL MARKETS ARE CLOSED ON FRIDAY APRIL 6, 2012 AND MANY ARE CLOSED ON MONDAY APRIL 9, 2012 ALSO. VOLUME WILL BE LIGHT AND TRADERS WILL BE POSITIONING THEMSELVES FOR THE LONG HOLIDAY WEEKEND. ECONOMIC REPORTS WILL CONTINUE TO BE RELEASED ON FRIDAY, IN THE US THE NON FARMS PAYROLL REPORTS WILL BE ISSUED ON FRIDAY

Crude Oil prices moved sharply lower Wednesday, adding to earlier losses after a weekly government supplies report showed an increase nearly five times larger than expected.

Prices also reeled from a firmer dollar and a decline in U.S. stocks in the wake of the release of U.S. Federal Reserve minutes showing officials unlikely to launch additional monetary stimulus.

Crude-oil dropped by $2.45, to $101.51 a. The drop follows a $1.22 loss in the previous session and marked the lower prices for crude since mid February.

The Energy Information Administration reported an increase in crude stockpiles by 9 million barrels in the week ended March 30. That contrasts with expectations of an increase by 1.9 million barrels, according to analysts polled by Platts.

With dramatically large increase in crude oil inventories and the recent strength in the dollar after the Fed minutes, markets can see a much larger push lower across the entire energy complex in the days to come with the absence of any new headlines out of Iran, don’t be surprised to see crude break the $100 level in the upcoming days.

Economic Events: (GMT)

WEEKLY

-

This Week in Petroleum

Release Schedule: Wednesday @ 1:00 p.m. EST (schedule) -

Gasoline and Diesel Fuel Update

Release Schedule: Monday between 4:00 and 5:00 p.m. EST (schedule) -

Weekly Petroleum Status Report

Release Schedule: The wpsrsummary.pdf, overview.pdf, and Tables 1-14 in CSV and XLS formats, are released to the Web site after 10:30 a.m. (Eastern Time) on Wednesday. All other PDF and HTML files are released to the Web site after 1:00 p.m. (Eastern Time) on Wednesday. Appendix D is produced during the winter heating season, which extends from October through March of each year. For some weeks which include holidays, releases are delayed by one day. (schedule)

Economic Events April 4, 2012 actual v. forecast

|

AUD |

Trade Balance |

-0.48B |

1.00B |

-0.97B |

|

GBP |

Halifax House Price Index (MoM) |

2.2% |

-0.3% |

-0.4% |

|

GBP |

Services PMI |

55.3 |

53.5 |

53.8 |

|

EUR |

Retail Sales (MoM) |

-0.1% |

0.1% |

1.1% |

|

EUR |

German Factory Orders (MoM) |

0.3% |

1.2% |

-1.8% |

|

PLN |

Polish Interest Rate Decision |

4.50% |

4.50% |

4.50% |

|

EUR |

Interest Rate Decision |

1.00% |

1.00% |

1.00% |

|

USD |

Treasury Secretary Geithner Speaks |

|||

|

RUB |

Russian CPI (MoM) |

0.6% |

0.5% |

0.4% |

|

USD |

ADP Nonfarm Employment Change |

209K |

200K |

230K |

|

EUR |

ECB Press Conference |

|||

|

USD |

ISM Non-Manufacturing Index |

56.0 |

57.0 |

57.3 |

Economic Events scheduled for April 5, 2012 that affect the American Markets

13:30 USD Initial Jobless Claims 355K 359K

13:30 USD Continuing Jobless Claims 3350K 3340K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week.

.

Originally posted here