By FXEmpire.com

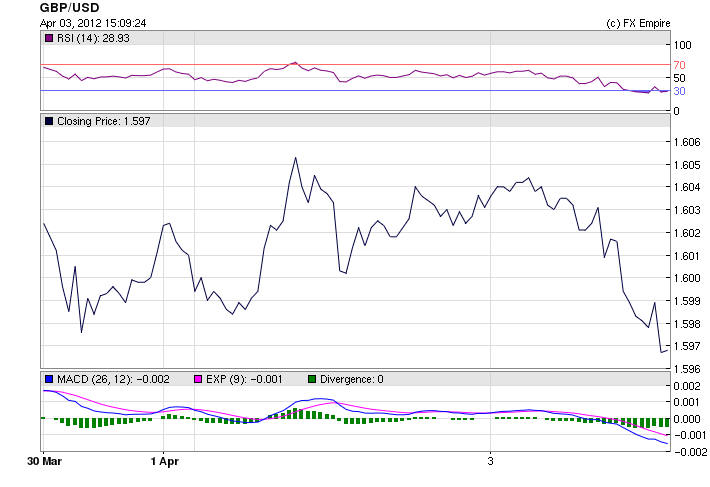

GBP/USD Fundamental Analysis April 4, 2012, Forecast

Analysis and Recommendations:

The GBP/USD is currently has fallen under the 1.60 level, it was hard for the pound to sustain that level when it broke through late last week. Although a strong construction report in the UK supported the sterling, there as a preponderance of positive news from the US today.

In a report, market research firm Markit and the Chartered Institute of Purchasing & Supply said that their U.K. construction purchasing managers’ index rose by 2.4 points to a seasonally adjusted 56.7 in March from a reading of 54.3 in February. Economists had expected the index to ease down by 0.8 points to 53.5 in March. On the index, a level above 50.0 indicates industry expansion, below indicates contraction. March data signaled a marked expansion of U.K. construction sector output, with the rate of growth accelerating for a second successive survey period.

In the US, orders for goods produced in U.S. factories rose 1.3% in February, the Commerce Department reported today. Economists surveyed expected orders to climb 1.5%. Factory orders were revised down to a 1.1% decline in January. The report was still positive and supported recovery, while automakers, reported the best month in years. Also two other indicators, including Redbook and NAPM both had positive scores.

Markets are now waiting for the release of the FOMC minutes, which might cause a reaction with the USD depending on how the minutes are interpreted.

Economic Events April 3, 2012 actual v. forecast

|

JPY |

Monetary Base (YoY) |

-0.2% |

12.6% |

11.3% |

|

JPY |

Average Cash Earnings (YoY) |

0.7% |

0.2% |

-0.9% |

|

AUD |

Retail Sales (MoM) |

0.2% |

0.3% |

0.3% |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

AUD |

RBA Rate Statement |

|||

|

TRY |

Turkish CPI (MoM) |

0.41% |

0.59% |

0.56% |

|

TRY |

Turkish PPI (MoM) |

0.36% |

0.74% |

-0.09% |

|

GBP |

Construction PMI |

56.7 |

53.5 |

54.3 |

|

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

|

EUR |

PPI (MoM) |

0.6% |

0.5% |

0.8% |

|

GBP |

10-Year Treasury Gilt Auction |

2.22% |

2.18% |

|

|

BRL |

Brazilian Industrial Production (YoY) |

-3.9% |

-5.8% |

-3.4% |

|

USD |

Redbook (MoM) |

0.70% |

0.50% |

|

|

USD |

New York NAPM |

551.80 |

543.10 |

|

|

USD |

Factory Orders (MoM) |

1.3% |

1.5% |

-1.1% |

|

USD |

Global Semiconductor Sales (MoM) |

-1.3% |

-2.7% |

Economic Events scheduled for April 4, 2012 that affect the European and American Markets

TBD GBP Halifax House Price Index (MoM) -0.3% -0.5%

The Halifax House Price Index measures the change in the price of homes and properties financed by Halifax Bank Of Scotland (HBOS), one of the U.K.’s largest mortgage lenders. It is a leading indicator of health in the housing sector.

09:30 GBP Services PMI 53.5 53.8

The Services Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the services sector. A reading above 50 indicates expansion in the sector; a reading below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

10:00 EUR Retail Sales (MoM) 0.1% 0.3%

Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

11:00 EUR German Factory Orders (MoM) 1.2% -2.7%

German Factory Orders measures the change in the total value of new purchase orders placed with manufacturers for both durable and non-durable goods. It is a leading indicator of production.

12:45 EUR Interest Rate Decision 1.00% 1.00%

The six members of the European Central Bank (ECB) Executive Board and the 16 governors of the euro area central banks vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

13:00 USD Treasury Secretary Geithner Speaks

Timothy Geithner (January 2009 – January 2013) is to speak. He speaks frequently on a broad range of subjects and his speeches are often used to signal policy shifts to the public and to foreign governments.

13:15 USD ADP Nonfarm Employment Change 200K 216K

The ADP National Employment Reportis a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile.

13:30 EUR ECB Press Conference

The European Central Bank (ECB) press conference is held monthly, about 45 minutes after the Minimum Bid Rate is announced. The conference is approximately an hour long and has two parts. Firstly, a prepared statement is read, then the conference is open to press questions. The press conference examines the factors which affected the ECB’s interest rate decision and deals with the overall economic outlook and inflation. Most importantly, it provides clues regarding future monetary policy. High levels of volatility can frequently be observed during the press conference as press questions lead to unscripted answers.

15:00 USD ISM Non-Manufacturing Index 57.0 57.3

The Institute of Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI ) rates the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories. The data is compiled from a survey of approximately 400 purchasing managers in the non-manufacturing sector. On the index, a level above 50 indicates expansion; below indicates contraction.

Government Bond Auctions (this week)

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here