By FXEmpire.com

AUD/USD Fundamental Analysis April 5, 2012 Forecast

Analysis and Recommendation: (close of Asian session)

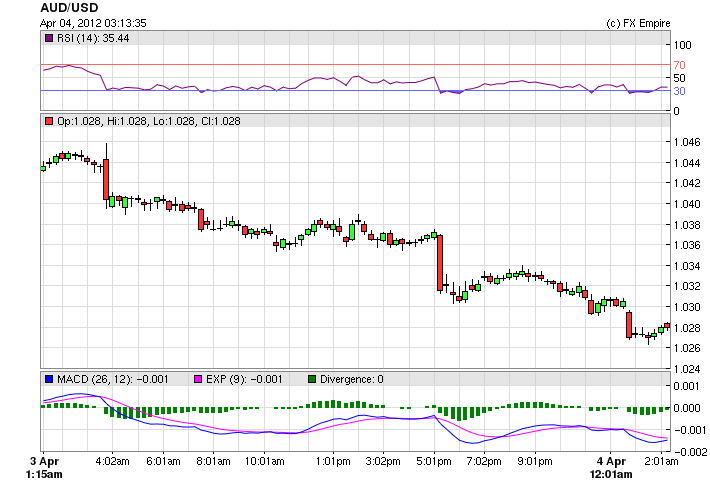

The AUD/USD is holding as markets close at 1.0278 and has been trending down since last week.

The Australian dollar fell to its lowest level since January, after the US Federal Reserve indicated it would not be taking action to further stimulate the American economy.

The Aussie dollar was trading at $US1.0278, having fallen from an opening price of $1.0331 on the news.

On January 17, the Australian dollar hit a low of $US1.03. The local unit has fallen as low as $1.0287 in today’s trade.

Australia’s trade deficit has narrowed in February, against expectations of a surplus, according to data from the Australian Bureau of Statistics. According to the figures, Australia’s trade deficit for the month of February was a seasonally adjusted $480 million, an improvement of $491 million on last month. The result follows a downwardly-revised deficit of $971 million in January. Economists’ forecasts had centered on a surplus of $1.1 billion in February.

Activity in the Australian services sector contracted in March, as trading conditions weakened and the local currency stayed strong, a private survey shows. The Australian Industry Group/Commonwealth Bank Australian Performance of Services Index (PSI) rose 0.3 points to 47.0 points in March. A reading below 50 indicates a contraction in activity.

Only two of the nine sub-sectors covered by the survey recorded rises in activity. They were finance and insurance, and personal and recreational services.

.The high (Australian) dollar is thwarting the prospects for trade-exposed service businesses and a lack of confidence among households is holding back the retail sector and service businesses.

Economic Events April 3, 2012 actual v. forecast

|

JPY |

Monetary Base (YoY) |

-0.2% |

12.6% |

11.3% |

|

JPY |

Average Cash Earnings (YoY) |

0.7% |

0.2% |

-0.9% |

|

AUD |

Retail Sales (MoM) |

0.2% |

0.3% |

0.3% |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

AUD |

RBA Rate Statement |

|||

|

TRY |

Turkish CPI (MoM) |

0.41% |

0.59% |

0.56% |

|

TRY |

Turkish PPI (MoM) |

0.36% |

0.74% |

-0.09% |

|

GBP |

Construction PMI |

56.7 |

53.5 |

54.3 |

|

EUR |

GDP (QoQ) |

-0.3% |

-0.3% |

-0.3% |

|

EUR |

PPI (MoM) |

0.6% |

0.5% |

0.8% |

|

GBP |

10-Year Treasury Gilt Auction |

2.22% |

2.18% |

|

|

BRL |

Brazilian Industrial Production (YoY) |

-3.9% |

-5.8% |

-3.4% |

|

USD |

Redbook (MoM) |

0.70% |

0.50% |

|

|

USD |

New York NAPM |

551.80 |

543.10 |

|

|

USD |

Factory Orders (MoM) |

1.3% |

1.5% |

-1.1% |

|

USD |

Global Semiconductor Sales (MoM) |

-1.3% |

-2.7% |

Economic Events for April 5, 2012 that affect the AUD, NZD and the JPY

As the Easter holiday draws closer and with several Asian Markets closed mid week for local holidays volume is down and there are no economic events scheduled for the Asian Markets.

In the US we will see:

13:30 USD Initial Jobless Claims 355K 359K

13:30 USD Continuing Jobless Claims 3350K 3340K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week.

Government Bond Auctions (this week)

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here