By FXEmpire.com

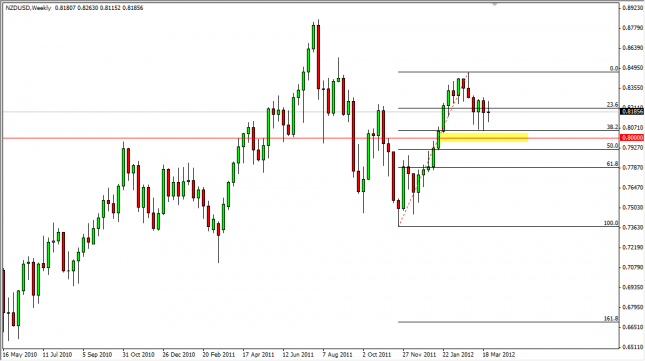

The NZD/USD pair had a back and forth week over the last five sessions to simply finish unchanged. The previous three weeks were all hammers, and as a result we think the path of least resistance is up. The 0.80 level is a massive support level, and we think that it should hold over the long run. The level is right between the 38.2% and 50% Fibonacci levels, and should attract a lot of buyers. The 200 day EMA is just under current levels as well, so this pair looks bullish to us. We are buying on dips.

NZD/USD Forecast for the Week of April 2, 2012, Technical Analysis

Originally posted here