By FXEmpire.com

NZD/USD Fundamental Analysis April 3, 2012, Forecast

Analysis and Recommendation: (close of the Asian session)

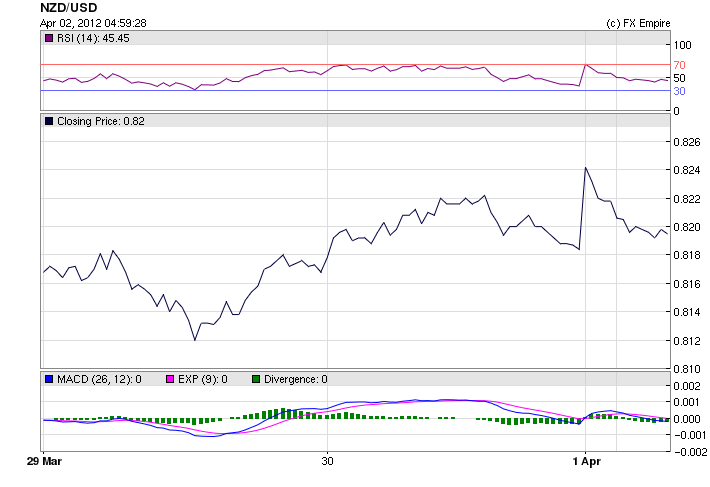

The NZD/USD is down trading at 0.8199 after hitting a high of 0.8246. The pair lost the strength of last week on a lackluster report from China. Chinese PMI reported, reduced factory output reflects falling new business from home and abroad. Combining this with a drop in manufacturing employment at sharpest rate in three years as well as input price inflation was higher, but remains modest overall.

Also in Japan the Tarkan Large Manufacturing Report remained at a -4, showing negative sentiment.

These two reports resulted in pressure on the kiwi as New Zealand is dependent on their imports and exports from these two countries. The Australia dollar also fell today.

Economic Data Monday April 2, 2012 actual v. forecast that affects the NZD, AUD, and JPY

|

KRW |

South Korean CPI (YoY) |

2.6% |

3.1% |

3.1% |

|

AUD |

AIG Manufacturing Index |

49.5 |

51.3 |

|

|

JPY |

Tankan Large Manufacturers Index |

-4 |

-1 |

-4 |

|

JPY |

Tankan Non-Manufacturers Index |

5 |

5 |

4 |

|

AUD |

MI Inflation Gauge (MoM) |

0.5% |

0.1% |

|

|

AUD |

Building Approvals (MoM) |

-7.8% |

0.3% |

1.1% |

|

IDR |

Indonesian Trade Balance |

0.70B |

0.93B |

0.92B |

Economic Calendar April, 3 2012 events that affect the NZD, AUD and JPY

02:30 AUD Retail Sales (MoM) 0.3% 0.3%

Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

05:30 AUD Interest Rate Decision 4.25% 4.25%

05:30 AUD RBA Rate Statement

Reserve Bank of Australia (RBA) board members come to a consensus on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation. The Reserve Bank of Australia’s (RBA) monthly rate statement contains the outcome of bank’s interest rate decision and discusses the economic conditions that influenced the decision. It can also give investors clues to the outcome of future decisions.

19:00 USD FOMC Meeting Minutes

The Federal Open Market Committee (FOMC) Meeting Minutes are a detailed record of the committee’s policy-setting meeting held about two weeks earlier. The minutes offer detailed insights regarding the FOMC’s stance on monetary policy, so currency traders carefully examine them for clues regarding the outcome of future interest rate decisions.

Government Bond Auctions (this week)

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here