EUR/USD

The Euro maintained a solid tone in early Europe on Tuesday despite a slightly weaker than expected reading for German consumer confidence. Technical considerations tended to dominate during the session with markets looking to challenge option-related barriers above the 1.3375 area. The Euro briefly moved higher, but was unable to sustain the gains and retreated back towards the 1.3330 area later in the European session.

There were mixed influences surrounding the Euro-zone during the day as there was a sharp decline in Portuguese yields following optimism that there would be a stronger Euro-zone firewall in place which would help protect Portugal. There was solid demand for Italian bills in the latest auction, but there was an increase in Spanish six-month yields as underlying confidence surrounding the Spanish economy was weak.

The latest US consumer confidence reading was slightly weaker than expected with a reading of 70.2 for March from a revised 71.6 the previous month. The current expectations index increased while confidence in the future outlook deteriorated. Meanwhile, the Richmond Fed index dipped to 7 for the month from 20 previously while the Case-Shiller index recorded a 3.8% annual decline in prices for January.

Following Fed Chairman Bernanke’s comments on Monday, markets were on high alert over Fed rhetoric on Tuesday. Fed Governor Dudley remained cautious over the outlook, but also stated that there was unlikely to be any immediate action to provide fresh stimulus to the economy. The comments had some impact in reversing quantitative-easing expectations which also provided some degree of dollar support. Bernanke was broadly neutral in his latest media interview and there will be further policy uncertainty in the short term. The Euro nudged lower in Asia on Wednesday, although ranges were very narrow.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar drifted weaker during the European session on Tuesday with lows just below the 82.70 level as there was profit taking on short yen positions.

The dollar found support at lower levels and rallied firmly during the New York session with a high close to the 83.40 area. Activity on the crosses remained an extremely important market focus and the yen dipped to lows just beyond the 111 level.

Risk appetite was generally firm during the day as global stock-markets pushed to eight-month highs. There were also expectations that the Bank of Japan would maintain a dovish stance which would undermine the yen. The yen resisted further losses on Wednesday with the currency boosted by weaker regional equity markets and speculation of year-end capital flows back to Japan with the dollar dipping back to below 83.

Sterling

Sterling maintained a solid tone during the European session on Tuesday with technical considerations playing an important role as markets challenged important levels. There was interest in breaking reported option barriers in the 1.60 region while the UK currency was also trading close to the 200-day moving average.

The latest CBI retail sales report was slightly stronger than expected with a reading of zero for March from -2 previously while retailers expected a weaker outcome for April as underlying confidence surrounding the sector remained fragile.

The UK currency was unable to break through the 1.60 area against the dollar and edged back towards the 1.5950 region, although pullbacks were still relatively limited.

There was further doubts surrounding the Bank of England monetary policy and the potential for quantitative easing, but markets were waiting for further evidence at this stage. The high level of uncertainty was reflected by comments from Governor King who stated that he did not know if further measures would be needed.

Swiss franc

The dollar found some support on dips towards the 0.90 level against the franc on Tuesday, but was unable to make significant headway and was trapped close to the 0.9050 region. The Euro was unable to make further progress and dipped back to the 1.2055 area.

There is likely to be some speculation that the National Bank will intervene to underpin the US currency as part of the strategy to block any Euro advance against the Swiss currency. There will be concerns that any further stresses surrounding the Spanish economy will trigger a fresh flow of funds into the Swiss currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

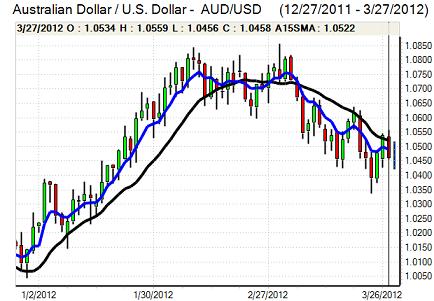

Australian dollar

The Australian dollar pushed to a peak close to 1.0550 against the US currency during Tuesday as risk appetite remained firmer, but it was unable to sustain the gains and was subjected to renewed selling pressure later in the US session with a retreat back to below 1.05.

There were further concerns surrounding the Chinese economic outlook which had an important impact in curbing Australian dollar demand. This trend continued in local trading on Wednesday as regional equity markets were subjected to further selling pressure on growth fears. Broadly encouraging comments from the Reserve Bank did not have a significant impact and the currency retreated back towards 1.0420.