By FXEmpire.com

GBP/USD Fundamental Analysis March 27, 2012, Forecast

Analysis and Recommendations:

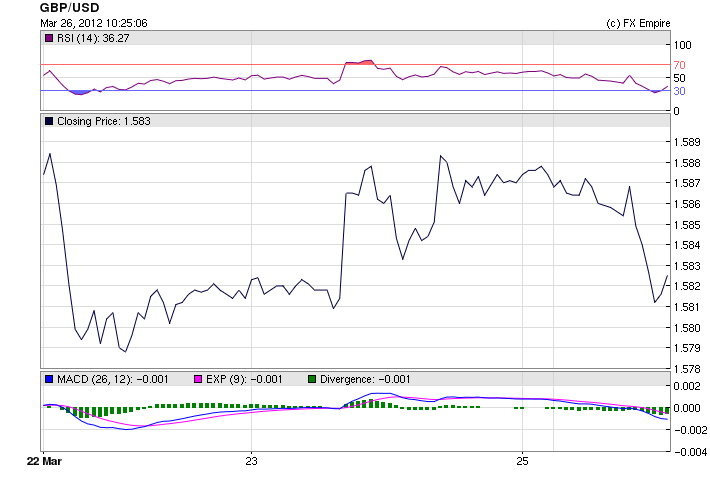

The GBP/USD is currently at 1.5945 at the high for the day. The USD began to fall against all of its trading partners as Fed Chairman Bernanke, began his speech today.

Bernanke’s speech “reiterated themes that Federal Reserve policy makers have used to justify policy accommodation since last summer,” wrote economists at Nomura Global Economics, who said the arguments used by Bernanke — largely pointing to weakness in the labor market despite some recent signs of improvement — support further policy action.

The Fed’s policy of keeping rates near 0% and taking extraordinary measures to boost the economy, such as buying large amounts of bonds, have been credited, in concert with similar actions by other central banks, in lifting U.S. stocks out of a bear market three years ago. The S&P 500 has more than doubled since then.

Pending home sales dipped slightly in February, according to an industry trade group. The National Association of Realtors said its pending sales index fell to 96.5% last month from 97.0% in January, although it’s still 9.2 percentage points.

As Bernanke spoke the USD fell and gold soared. The Fed Chairman has a way of turning the markets upside down.

His brief mention of monetary easing sent the stock markets climbing and the currency markets falling.

He is scheduled to speak again Tuesday evening.U.S. Federal Reserve Chairman Ben Bernanke said the central bank’s ultra-low interest rate policy can help the labor market, but warned that faster economic growth was crucial to ensuring further recovery.The improvement in the labor market since last fall may only be a reversal of large layoffs during the recession, and further improvement may depend on faster economic growth

Economic Data affecting the EUR, CHF, GBP and USD March 26, 2012 actual v. forecast

|

EUR |

German Ifo Business Climate Index |

109.8 |

109.7 |

109.7 |

|

EUR |

German Current Assessment |

117.4 |

117.0 |

117.4 |

|

EUR |

German Business Expectations |

102.7 |

102.6 |

102.4 |

Economic Events Scheduled for March 27, 2012

All Day G7 Meeting

The G7 meeting is the meeting of the finance ministers from the group of seven industrialized nations that are the United States, Japan, Germany, France, United Kingdom, Italy and Canada. The meeting takes place several times a year to discuss economic policy. Traders should pay close attention to this event as it might bring a new dimension to the markets.

07:00 EUR GfK German Consumer Climate 6.2 6.0

The Gfk German Consumer Climate Index measures the level of consumer confidence in economic activity. The data is compiled from a survey of about 2,000 consumers which asks respondents to rate the relative level of past and future economic conditions.

11:00 GBP CBI Distributive Trades Survey -4 -2

The Confederation of British Industry (CBI) Distributive Trades Survey (DTS) measures the health of the retail sector. The reading is compiled from a survey covering 20,000 firms responsible for 40% of employment in retailing. It includes measures of sales activity across the distributive trades. It is a leading indicator of consumer spending. The figure is the difference between the percentage of retailers reporting an increase in sales and those reporting a decrease.

13:00 USD S&P/Case-Shiller Home Price Indices -3.8% -4.0%

The S&P/Case-Shiller Home Price Indices released by the Standard & Poor’s examines changes in the value of the residential real estate market in 20 regions across the US. This report serves as an indicator for the health of the US housing market. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative, or bearish.

14:00 USD Consumer Confidence (Mar) 70.0 70.8

The Consumer Confidence released by the Conference Board captures the level of confidence that individuals have in economic activity. A high level of consumer confidence stimulates economic expansion while a low level drives to economic downturn. Generally, a high reading is also positive for the USD, while a low reading is negative.

14:00 USD Richmond Fed Manufacturing Index (Mar) 18 20

The survey including information on shipments, new orders, order backlogs, and inventories conducted by Federal Reserve Bank of Richmond provides information on current activity in the manufacturing sector (mailing 220 business organizations). The industry inflation can be seen from the survey. Generally speaking, a high reading appreciates (or is bullish for) the USD, whereas a low reading is seen as negative (or bearish for) the USD.

16:45 USD Fed’s Bernanke Speech

The Fed Governor Ben Bernanke was born in 1953. He graduated from Harvard University and a Ph.D. in economics in 1979 from the Massachusetts Institute of Technology. In 2006 he became the Chairman of the Federal Reserve System. He gives a press conference as to how the Fed observes the current US economy and the value of USD. His comments may determine a short-term positive or negative trend.

Government Bond Auctions (this week)

Mar 26 09:10 Norway Nok 3.0bn NST 474 3.75% May 2021 Bond

Mar 26 10:30 Germany Eur 3.0bn new Mar 2013 Bubill

Mar 26 15:30 Italy Details BTP/CCTeu auction on Mar 29

Mar 27 09:10 Italy CTZ/BTPei auction

Mar 27 08:30 Spain 3 & 6M T-bill auction

Mar 27 17:00 US Auctions 2Y Notes

Mar 28 09:10 Italy BOT auction

Mar 28 17:00 US Auctions 3Y Notes

Mar 29 09:10 Italy BTP/CCTeu auction

Mar 29 17:00 US Auctions 7Y Notes

Originally posted here