By FXEmpire.com

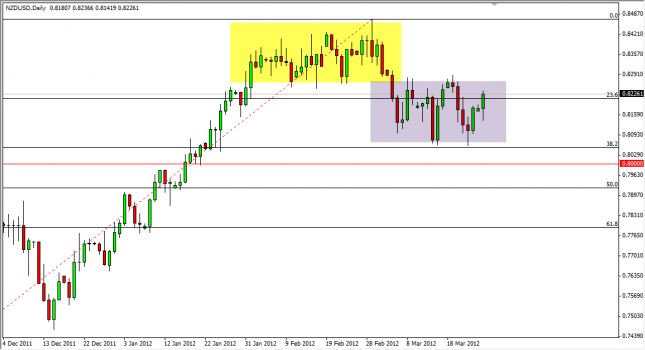

NZD/USD rose after first falling on Monday in reaction to the suggestion by Ben Bernanke that “Quantitative Easing 3” is still a possibility. This of course will weaken the Dollar overall and also push commodities higher. The Kiwi is a highly sensitive currency to commodities, and this should continue to be a bullish market going forward as the Dollar will fall. The 0.83 level above is a resistance area, as it was support from the previous consolidation area. We think that this pair should continue to be a “buy on the pullbacks” type of pair. We cannot sell this pair until the 50% Fibonacci level at the 79.50 is broken to the downside on a daily close.

NZD/USD Forecast March 27, 2012, Technical Analysis

Originally posted here