By FXEmpire.com

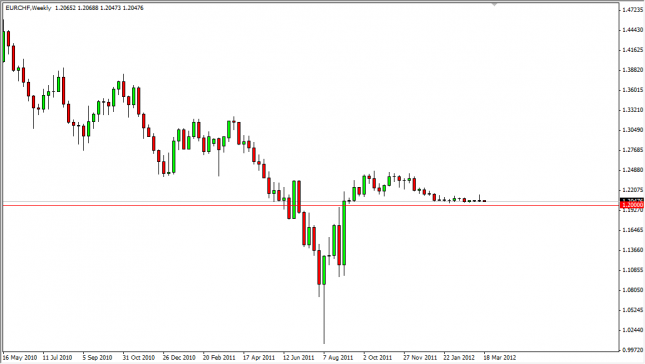

The EUR/CHF pair is being supported by the Swiss National Bank’s “minimum acceptable rate” at the 1.20 level. The market simply cannot be sold at this point, and buying is the only possibility at this point. The bullish case is one that can only be made by default, as the SNB intervening is the only thing that looks like it could make the buying of this pair work out on the longer time frames, and we believe that the 1.24 level could be where an intervention ends up at. However, we need to get below the 1.20 level to see this happen, and if we don’t – this pair will sit still. As a result, it really isn’t a long term trader’s type of market.

EUR/CHF Forecast for the Week of March 26, 2012, Technical Analysis

Originally posted here