By FXEmpire.com

Gold Weekly Fundamental Analysis March 26-30, 2012, Forecast

Introduction: Gold prices always rise when there is uncertainty in the global economy. In times of uncertainty, wealthy investors tend to run towards gold. Suppose, rumors are flying high about some event in the world and this is increasing the uncertainty in the financial markets.

- Gold reacts to uncertainty in the markets

- A drop in major currencies can indicate a run into gold.

- Remember investors tend to take profit from gold so watch for trading opportunities when investors are taking profits, not moving out of the markets.

Analysis and Recommendations:

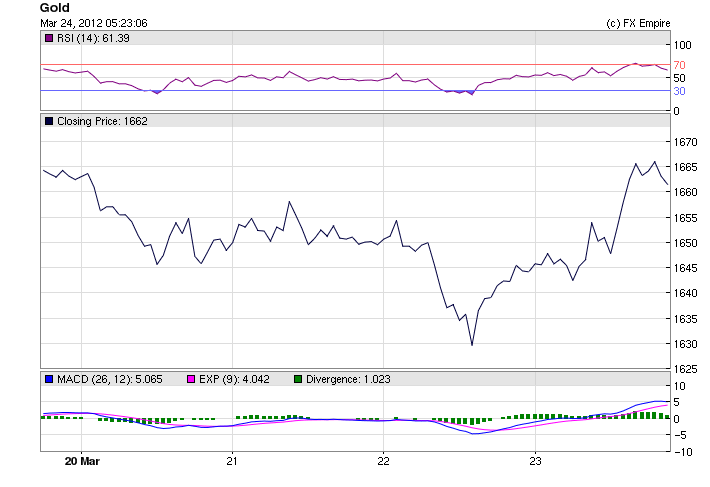

Gold showed weekly gains of 0.4%, ending the week at 1661.45. Gold futures rebound, adding nearly $20 an ounce to finish higher for the week as a decline in the U.S. dollar fed a broad rally in commodity markets. Looking ahead, analysts were a bit downbeat about the prospects for gold prices. Traders are expecting less liquidity injections (bond buying) by the federal government and as a realization of that permeates less active traders’ landscapes, we’ll see further declines in gold.

If we see any problems brewing in Europe this week or negative economic reports in the US we can expect Gold to continue up to the 1675.00 level, otherwise as the month comes to a close we can watch gold drop.

Historical

High: 1916.20

Low: 1321.10

Economic Events: (GMT)

Originally posted here