By FXEmpire.com

EUR/USD Fundamental Analysis March20, 2012, Forecast

Analysis and Recommendations:

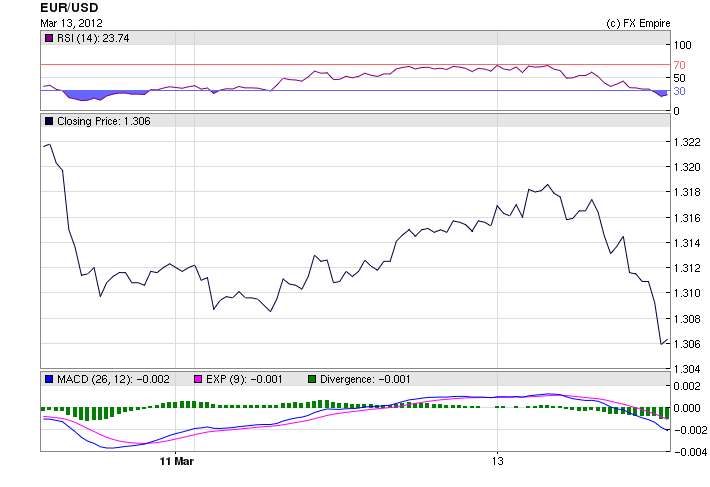

The EUR/USD came under pressure earlier, on worries over Portugal’s debt load after the chief executive of investment fund Pimco said the country will need a second bailout.

The duo traded at 1.3248 showing strength most of the day.

Towards the end of trading on Friday investors began to move from the USD to more risky investments. Compounded by a rise in U.S. yields — which happened very swiftly last week — has increased the extra yield investors around the world get over their local government bonds, boosting the appeal of switching into dollars to buy U.S. assets. Interest-rate differentials are historically a bigger driver of currency movements.

Yields, which move in the opposite direction of prices, accelerated a move to the upside last week after the statement following last Tuesday’s Fed policy meeting was viewed as reflecting a more upbeat economic environment, lessening prospects for a third round of monetary easing by the central bank.

Although today, William Dudley, the president of the New York Federal Reserve Bank, said despite some positive signs growth is on a firmer footing, the economy still faces significant headwinds. This is one of those glass half filled or half empty.

A separate report showed that the euro zone’s current account surplus increased to EUR4.5 billion in January, the highest level since March 2007, from an upwardly revised surplus of EUR3.4 billion in December.

In euro zone debt news, Investors were awaiting the outcome of the final stage of Greece’s debt restructuring deal, ahead of an auction to determine the payout on Greek credit default swaps.

Greece is more than halfway down the path to economic recovery and should be able to return to growth in less than two years, Lucas Papademos, the country’s caretaker prime minister, said in an interview published by the Financial Times.

Greek Finance Minister Evangelos Venizelos will resign from the government after being elected Sunday to head the Socialist party Pasok in national elections expected in late April or early May, news reports said Monday.

The initial phase of an auction to settle credit default swap, or CDS, contracts on Greek government debt was completed Monday morning, setting an initial market midpoint at 21.75, according to Creditex.

Irish Prime Minister Enda Kenny said he is confident Irish voters will approve the European Union’s new budget treaty in a referendum to be held later this year. If voters reject the treaty, the government would be denied access to the European Stability Mechanism.

Economic Data for March 19, 2012 actual v. forecast

|

GBP |

Rightmove House Price Index (MoM) |

1.6% |

4.1% |

|

|

AUD |

RBA Governor Stevens Speaks |

|||

|

EUR |

Current Account |

4.5B |

4.3B |

3.4B |

|

EUR |

Italian Industrial New Orders (MoM) |

-7.4% |

-3.8% |

5.2% |

|

CLP |

Chilean GDP (YoY) |

4.5% |

4.2% |

3.7% |

|

Wholesale Sales (MoM) |

-1.0% |

0.4% |

1.0% |

|

|

USD |

NAHB Housing Market Index |

28 |

30 |

28 |

|

USD |

3-Month Bill Auction |

0.095% |

0.095% |

Economic Events Scheduled for March 20, 2012 Europe and Americas

09:15 CHF Industrial Production (QoQ)

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

10:30 GBP Core CPI (YoY)

10:30 GBP CPI (YoY)

The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

12:00 GBP CBI Industrial Trends Orders

The Confederation of British Industry (CBI) Industrial Trends Orders measures the economic expectations of the manufacturing executives in the U.K. It is a leading indicator of business conditions. A level above zero indicates order volume is expected to increase; a level below zero indicates expectations are for lower volumes. The reading is compiled from a survey of about 550 manufacturers.

13:30 USD Building Permits

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 USD Housing Starts

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

Government Bond Auctions (this week)

Mar 21 10:10 Sweden Nominal bond auction

Mar 21 10:30 Germany Eur 5.0bn Mar 2014 Schatz

Mar 21 10:30 Portugal Eur 0.75-1.0bn 4 & 6M T-bills

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here