By FXEmpire.com

AUD/USD Fundamental Analysis March 20, 2012 Forecast

Analysis and Recommendation: (close of Asian session)

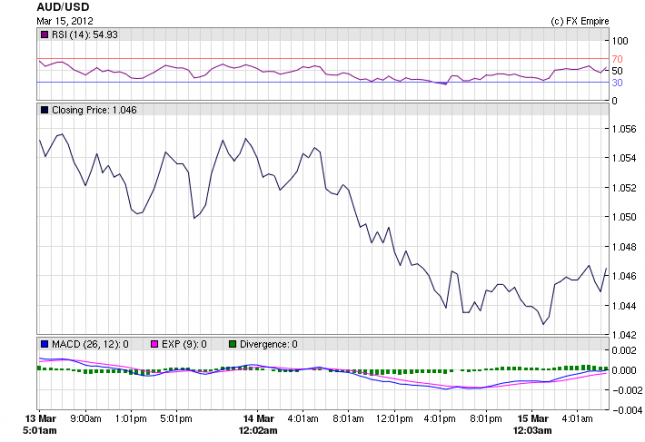

AUD/USD has been climbing in most of today’s session. Hitting a high mid day of 1.0616 and leveling off at 1.0605.

The markets are awaiting Glenn Stevens’ speech ( RBA ) if the governor will be more optimistic about the global economy, particularly around the Asian economic story. That should provide the Aussie with a bit more support. Mr. Stevens is due to speak at an investment conference in Hong Kong on Monday afternoon (morning GMT). A positive speech by Mr. Steven’s could push the Aussie up possibly over the 1.0650 level.

Below are excepts from the speech that have just been released. It is not negative or positive, I would rate it neutral.

Overall, recent economic performance in Australia is not too bad, particularly when compared, over a run of years, to a number of other advanced economies.

But neither is it so good that it cannot be improved. The full range of policies – macroeconomic and structural – need to play their part in seeking that improvement.

So for all of us, the challenges are those of adaptation to changing circumstances and new opportunities. A fascinating journey lies ahead. We in Australia will be facing our own adjustment imperative. We will also be taking more than a casual interest in developments in the region in this ‘Asian century’.

Asian Markets Economic Releases March 19, 2012 actual v. forecast.

|

Date |

Currency |

Event |

Actual |

Forecast |

Previous |

|

Mar. 18 |

NZD |

Westpac Consumer Sentiment |

102.4 |

101.3 |

Economic Calendar March 20, 2012 ( reports that affect the Asian Markets )

01:30 AUD Monetary Policy Meeting Minutes

The Reserve Bank of Australia (RBA) Monetary Policy Meeting Minutes are a detailed record of the bank’s most recent policy-setting meeting, containing in-depth insights into the economic conditions that influenced the rate decision.

13:30 USD Building Permits

Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

13:30 USD Housing Starts

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

22:45 NZD Current Account

The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the nation’s exports the data can have a sizable affect on the NZD.

Government Bond Auctions (this week)

Mar 21 10:10 Sweden Nominal bond auction

Mar 21 10:30 Germany Eur 5.0bn Mar 2014 Schatz

Mar 21 10:30 Portugal Eur 0.75-1.0bn 4 & 6M T-bills

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here