EUR/GBP Weekly Fundamental Analysis March 16-24, 2012, Forecast

Introduction: The cross tends to move in ranges, with relatively clear barriers. The narrower ranges made it somewhat harder, but it seems to return to wider ranges. The GBP is does not seem to move in response to the EUR as directly currently. The UK austerity program vs. The EU debt crisis seems to have them moving in opposing distances. They are developing new trading personalities and there is a good deal of profit to be made trading this pair. They can be volatile.

- The interest rate differential between the European Bank(ECB) and the Bank of England(BoE)

- European and UK economic data

- Growth differentials between the Euro zone and UK

Analysis and Recommendations

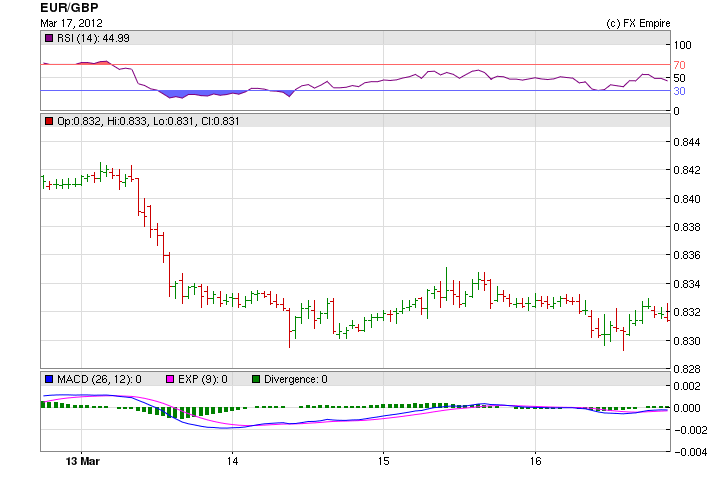

The EUR/GBP has been in a wide range this week as the euro has been up and down against all of its trading partners. The duo reached as high as 0.8424 and fell as low as 0.8294. The Pound is currently trading at 0.8316.

There was not much in the way of data this past week, and Greece finally moved out of the spotlight.

The highlights in the UK were the affirmation of the UK AAA rating but a change to a negative outlook by Fitch and also a very disappointing jobs report

The euro picked and lost strength on wide moves by the US, which was supported throughout the week by positive economic data, until late in Friday trading, investors worried that some inflationary news, would put any plans for monetary easing out of the Fed’s thoughts. Also investors’ appetite for risk increased as they moved late Friday into other assets and commodities.

This week brings little in the way of data except for the all important retail sales figures in the UK which could cause the sterling to fall, on the other hand, there is no support for the euro and the euro is expected to decline against the USD, so this pair might just balance out and stay in this range.

Historical:

Highest: 1.2336 EUR on 29 Jun 2010.

Average: 1.1548 EUR over this period.

Lowest: 1.0686 EUR on 13 Oct 2009

Major Economic Events for the week of March 19-24

|

Mar. 20 |

01:30 |

AUD |

Monetary Policy Meeting Minutes |

|

Mar. 21 |

10:30 |

GBP |

MPC Meeting Minutes |

|

15:00 |

USD |

Existing Home Sales |

|

|

22:45 |

NZD |

GDP (QoQ) |

|

|

Mar. 22 |

10:30 |

GBP |

Retail Sales (MoM) |

|

13:30 |

Core Retail Sales (MoM) |

||

|

13:30 |

USD |

Initial Jobless Claims |

|

|

17:00 |

EUR |

ECB President Draghi Speaks |

|

|

Mar. 23 |

12:00 |

CAD |

Core CPI (MoM) |

|

15:00 |

USD |

New Home Sales |

The week’s highlights

In Australia, data on skilled vacancies and merchandise imports is set for release.

The Bank of England will also release the minutes of its last meeting, while data on housing starts and building approvals is due in the United States.

The European Union will release draft proposals regarding the regulation of shadow banks.

The International Monetary Fund will host high level talks at the two day China-India conference in New Delhi.

RBA Governor Glenn Stevens will speak at an investment conference in the week ahead.

Monday

The National Association of Home Builders housing market index for March will be released in the United States on Monday.

Tuesday

The RBA will release the minutes of its March policy meeting, where it kept the official cash rate on hold for the second consecutive time. Investors will watch carefully for any reflection on the expected direction that rates will take over the rest of the year. Most economists are still expecting at least one more rate cut in 2012.

US February housing starts figures and building approval data released. Economists are forecasting housing starts to be flat for the month, at around 700,000.

In the United Kingdom, February consumer price index data is awaited, alongside retail price index figures for the month.

Wednesday

The international merchandise figures for February reported by the Australian Bureau of Statistics. Also the Department of Education and Workplace Relations will release its skilled vacancies index for February.

February existing home sales figures in the US, along with the weekly Energy Information Administration petroleum status report. Analysts expect the data to show a rise in home sales of about two per cent.

Thursday

Mortgage Bankers Association mortgage applications figures are also due.

Elsewhere, the Bank of England will release the minutes of its last policy meeting.

UK public sector net borrowing for February is also due.

Also due is the highly anticipated jobless claims data is out in the US. February retail sales data is expected in the UK.

Friday

US new home sales figures for February and experts expect sales to have risen by 6,000 to 327,000.

Economic Releases for the week of March 12-16

|

Mar. 13 |

JPY |

Interest Rate Decision |

0.10% |

0.10% |

0.10% |

|

EUR |

German ZEW Economic Sentiment |

22.3 |

10.5 |

5.4 |

|

|

USD |

Core Retail Sales (MoM) |

0.9% |

0.8% |

1.1% |

|

|

USD |

Retail Sales (MoM) |

1.1% |

1.1% |

0.6% |

|

|

USD |

Interest Rate Decision |

0.25% |

0.25% |

0.25% |

|

|

Mar. 14 |

GBP |

Claimant Count Change |

7.2K |

6.0K |

7.0K |

|

Mar. 15 |

CHF |

Interest Rate Decision |

0.00% |

0.00% |

0.00% |

|

USD |

Initial Jobless Claims |

351K |

356K |

365K |

|

|

Mar. 16 |

USD |

Core CPI (MoM) |

0.1% |

0.2% |

0.2% |

|

USD |

CPI (MoM) |

0.4% |

0.4% |

0.2% |

Government Bond Auctions (this week)

Mar 19 n/a Greece CDS Auction

Mar 19 10:10 Slovakia Bond auction

Mar 19 10:10 Norway T-bill auction

Mar 20 09:30 Spain 12 & 18M T-bill auction

Mar 21 10:10 Sweden Nominal bond auction

Mar 21 10:30 Germany Eur 5.0bn Mar 2014 Schatz

Mar 21 10:30 Portugal Eur 0.75-1.0bn 4 & 6M T-bills

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here