By FX Empire.com

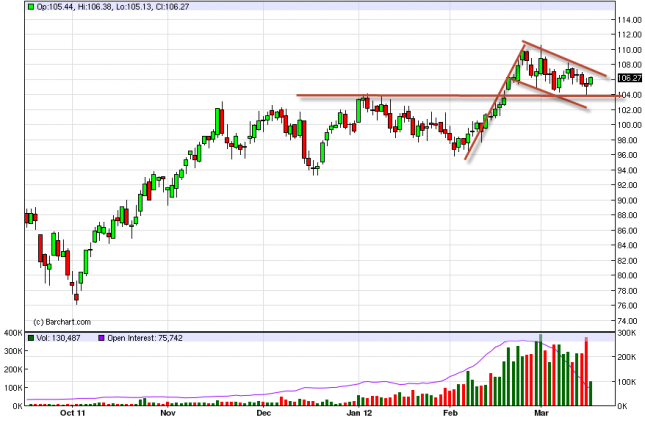

The Light Sweet Crude markets continued to have a bid in them on Friday, breaking the top of the Thursday range and therefore getting us long again. The flag is still intact, and looks very promising. Also, the $104 level will have been shown to be supportive yet again, and this continues to suggest that we are going higher in the near future.

The Iranians haven’t backed down from Western demands of ceasing their nuclear program, and the SWIFT routing system is now off limits for the Iranian central bank. This makes getting paid for their oil very, very difficult. In a sense, the West is ratcheting up the pressure, and now it is a matter of waiting to see what the Iranians are about to do. Needless to say, the headline risk is now higher than it had been.

The charts look overly bullish, and the uptrend looks set to continue. The Thursday session produced a great looking hammer on the support line at $104, and we suggested that a brake of the top of Thursday’s range would signal that the market will more than likely rise from that area and towards the $110 handle.

The $110 handle will be resistive, but in fact it is above the top of the flag, and as such should only be a minor stop along the way. The “pole” of the flag suggests that the market is heading to the $122 level if we break above the top line of the pattern, so getting out at $110 makes absolutely no sense to us.

The selling of this pair is absolutely impossible as there are simply far too many bad things and headlines that can come out to push prices higher. The US economy is starting to grow, albeit slowly, and this will more than likely help out the demand side of this market. Also, one must remember that the Chinese and Indian markets are showing high demand for fuel, so even outside of the US – we have serious demand. We are long now, and wouldn’t hesitate to buy at this level.

Oil Forecast March 19, 2012, Technical Analysis

Originally posted here