Gold Fundamental Analysis March 16, 2012, Forecast

Analysis and Recommendations:

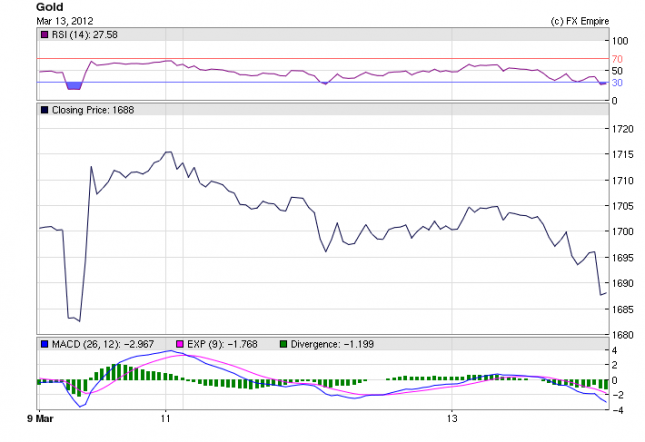

Gold is up 15.95 trading at 1658.75. Gold rebounded on Thursday as investors flocked to the metal on a combination of bargain hunting and a weak U.S. dollar. Gold investors had sold off in response to declining likelihood of additional expansionary policies from the Federal Reserve.

Gold sank 3% on Wednesday, settling at its lowest in more than eight weeks, as fading hopes of monetary stimulus dulled demand for the metal.

Today brought a slew of positive economic data in the US, which investors saw as a sign to move to more risky assets, there by weakening the USD in the sell off and making gold a more attractive buy at its lowered prices. Investors are hoping to see gold make a rebound to the 1700.00 range.

Released Economic Reports for March 15, 2012 actual v. forecast

|

Date |

Time |

Currency |

Event |

Actual |

Forecast |

Previous |

|

Mar. 15 |

09:30 |

CHF |

Interest Rate Decision |

0.00% |

0.00% |

0.00% |

|

10:00 |

EUR |

ECB Monthly Report |

||||

|

11:00 |

EUR |

Employment Change (QoQ) |

-0.2% |

-0.2% |

-0.2% |

|

|

13:30 |

USD |

Core PPI (MoM) |

0.2% |

0.2% |

0.4% |

|

|

13:30 |

USD |

PPI (MoM) |

0.4% |

0.5% |

0.1% |

|

|

13:30 |

USD |

Initial Jobless Claims |

351K |

356K |

365K |

|

|

13:30 |

USD |

NY Empire State Manufacturing Index |

20.2 |

17.4 |

19.5 |

|

|

13:30 |

USD |

Continuing Jobless Claims |

3343K |

3405K |

3424K |

|

|

14:00 |

USD |

TIC Net Long-Term Transactions |

101.0B |

29.3B |

19.1B |

|

|

15:00 |

USD |

Philadelphia Fed Manufacturing Index |

12.5 |

11.4 |

10.2 |

Economic Events for March 16, 2012

Time Currency Event Forecast Previous

13:30 CAD Foreign Securities Purchases 6.27B 7.38B

Foreign Securities Purchases measures the overall value of domestic stocks, bonds, and money-market assets purchased by foreign investors.

13:30 CAD Manufacturing Sales (MoM) 0.60% 0.60%

Manufacturing Sales measures the change in the overall value of sales made at the manufacturing level.

13:30 USD Core CPI (MoM) 0.2% 0.2%

13:30 USD CPI (MoM) 0.4% 0.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

14:15 USD Industrial Production (MoM) 0.4% 0.0%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

14:55 USD Michigan Consumer Sentiment Index 75.7 75.3

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

Government Bond Auction Schedule (this week)

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Originally posted here