In a sense the weakness in gold prices is helping to take some of the upward pressure off of crude oil prices. But… more on this a bit further down the page.

Bond and gold prices tumbled yesterday. We have been arguing that both were already in down trends so this wasn’t much of a surprise.

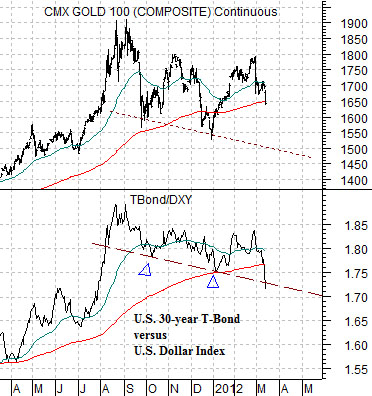

At top right is a comparative view of gold futures and the ratio between the U.S. 30-year T-Bond futures and the U.S. Dollar Index (DXY) futures.

The idea is that the trend for gold is almost ‘dead on’ the trend for the ratio between the TBond and dollar. Gold is pushed upwards by rising bond prices and is helped by a weaker dollar. The best combination for gold includes strong and rising long-term bond prices and significant dollar weakness. On the other hand… the worst combination for gold includes weak bond prices (yesterday’s markets feature) and a stronger dollar (also part of yesterday’s trading theme).

Below right is a view of the U.S. 30-year T-Bond futures and the ratio between gold and crude oil futures.

In a broad sense the trend for long-term bond prices is similar to the trend for the gold/crude oil ratio as well as the gold/copper ratio. When bond prices are moving higher the price of gold should outperform both copper and crude oil while a weaker bond price trend will go with relative strength for energy and base metals prices. Fair enough.

So… from late summer of last year through to the current month the TBond futures essentially traded ‘flat’ while the markets awaited some indication that the pressure was starting to fade from the financial sector. A flat bond market does not put significant pressure on the gold/crude oil ratio so a rising trend for oil prices will tend to support gold. And vice versa.

From 2009 into 2011 the gold/crude oil ratio has tended to decline to around 13:1 at bond price bottoms. With bonds moving to the down side the gold/crude oil ratio should also be moving lower. With gold prices showing significant weakness the price of crude oil was allowed to fall at a slower pace. Bond prices declined, the gold/crude oil ratio declined, and oil prices declined but by a smaller percentage (roughly 1% versus 3%) than gold prices.

Equity/Bond Markets

On Tuesday the banking shares came to life. On Wednesday gold prices started to decline. Our view is that there is a relationship between both trends.

At top right is a comparison between Bank of America (BAC) and the ratio between gold and the CRB Index.

The gold/CRB Index ratio trended between around 1.2:1 up to 2.2:1 for a very long time while BAC pushed up its logarithmically scaled trading channel. Through the second half of 2007 and into 2008 the share price of BAC began to weaken until it broke down through its channel as the gold/CRB Index ratio went ballistic.

The argument is that a return to some kind of positive trend for the laggard banks (i.e. BAC) has to be confirmed by gold price weakness. So far, so good.

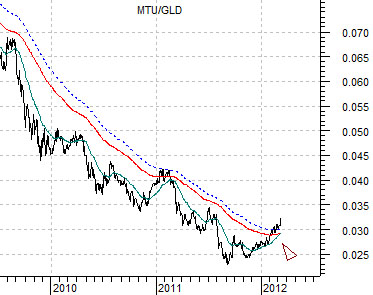

Another spin on this argument is shown below using the ratio between Japanese bank Mitsubishi UFJ (MTU) and the gold etf (GLD).

The idea here is that a trend change should include strength in MTU and weakness in the GLD. In other words… the ratio should rise. It should rise through the moving average lines with the 50-day e.m.a. crossing up through the 200-day. The point is that the ratio has now shown more strength than at any time since it last peaked in late 2005 relative to the moving average lines. Which is encouraging.

Below right is our rather messy chart comparison between the S&P 500 Index (SPX), price spread or difference between the 30-year and 10-year Treasury futures (30-10), and sum of the U.S. 30-year T-Bond futures plus the U.S. Dollar Index (DXY) futures.

The last two stock market peaks at the end of August and late October in 2011 were made when the 30-10 spread fell to 7- 8 while the sum of the TBond and DXY declined towards 210. The current rally began last December as the spread and sum reached the upper limits of the trading range.

The point? Still bullish but definitely some distance along the recovery process now that the 30-10 spread has declined to 9 points.