By FX Empire.com

The gold markets fell in the US afternoon on Tuesday as the Federal Reserve released a note that claimed inflation was nowhere to be found. This of course hurts the inflation trade when it comes to gold, but in the end – this will only be a slight setback for the market as there are plenty of central banks pumping liquidity into the markets.

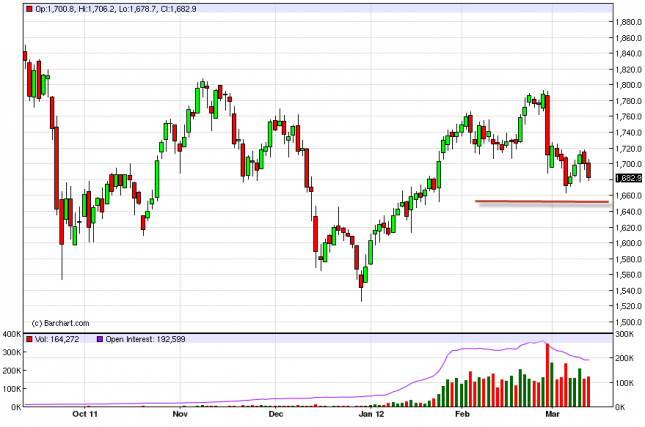

The $1,650 level below still looks supportive, and we are looking to see if there is a supportive reaction at that level in which to buy this market. The next couple of days should see us forming a bit of a base in the area, and it is after this that we are looking to buy. We are not selling gold until we break and close below $1,500 as it is our “line in the sand”.

Gold Forecast March 14, 2012, Technical Analysis

Originally posted here