EUR/USD

The Euro initially edged firmer in Europe on Tuesday and secured a brief advance from the German ZEW index which pushed to 22.3 for February from 5.4 previously which was the highest figure since June 2010. The data reinforced a more positive tone surrounding the German economy, although the current conditions estimate was weaker than expected.

Fitch removed the selective default rating on Greece reflecting the issuance of new bonds, although the impact was limited. There will important concerns surrounding Portugal and the medium-term Greek outlook which had some negative impact on the Euro. Expectations that the ECB would maintain a very expansionary monetary policy which pushed the currency weaker.

Bundesbank head Weidmann remained very cautious surrounding the aggressive ECB non-standard measures and also warned over the Spanish budget deficit, although he toned down any criticism of the bank’s policies.

The headline US retail sales data was close to expectations with a 1.1% increase for February. The underlying data was stronger than expected and there were upward revisions to January’s data which helped boost sentiment towards the US economy. The US dollar managed to out-perform other currencies on yield considerations which initially pushed the Euro weaker, but there was support on dips to lows 1.3050.

As expected, the Federal Reserve left interest rates on hold below 0.25% following the latest FOMC meeting. There was a more optimistic stance on the economy with expectations of moderate growth and there was greater confidence in the labour market while financial-market tensions had eased. There was no mention of further quantitative easing, but there was still an expectation that interest rates would remain at exceptionally low levels through 2014.

Regional Fed President Lacker dissented against the interest rate pledge and the lack of quantitative easing references helped boost the dollar. US 10-year yields rose to a 15-week high which helped underpin the dollar and the Euro retreated again during the Asian session on Wednesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar initially retreated from the 82.70 region on Tuesday with exporters taking advantage of the stronger levels. Dollar retreats were limited and the currency gained fresh support from the stronger than expected US economic data.

The dollar gained further support on yield grounds following the Federal Reserve statement and pushed to fresh 11-month highs just above the 83 level against the Japanese currency as US Treasuries continued to weaken.

Underlying confidence in the yen also remained weaker as structural concerns remained an important market focus with expectations that the current account position will remain substantially weaker than in previous years. There was also a much weaker than expected estimate for capital spending which will undermine confidence and the dollar consolidated above the 83 level.

Sterling

Sterling found fresh support on dips to the 1.5620 region against the dollar on Tuesday and recovered firmly during the New York session. The UK currency gained strongly against the Euro with an advance to the 0.8325 area on wider Euro selling pressure.

The UK trade data was slightly stronger than expected with a goods deficit of GBP7.5bn for January from a revised GBP7.2bn previously as there was support from a rise in exports to a record high. The housing data remained subdued with the DCLG house-price recording a 0.2% increase in the year to January. The net result was a slightly improved mood of confidence surrounding the economy with markets looking ahead to the Wednesday employment data.

Sterling moved back above the 1.57 level as support levels held before retreating again following the Fed statement with a move back to the 1.5660 region. Immediate Euro-zone related safe-haven demand for the currency is liable to be weaker, although the impact will be offset by a more confident tone surrounding the global economy.

Swiss franc

The dollar maintained a firm tone during the European session on Tuesday and peaked close to 0.9240 following the US economic data. The Euro was unable to make any significant headway against the Swiss currency. Producer prices rose 0.8% in February which helped ease fears surrounding deflation.

There is some possibility that the franc will be used as a global funding currency if there is greater confidence surrounding the outlook. The main focus is still likely to be on the National Bank meeting on Thursday and there was a reluctance to hold the currency given the potential for a more aggressive tone by the bank.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

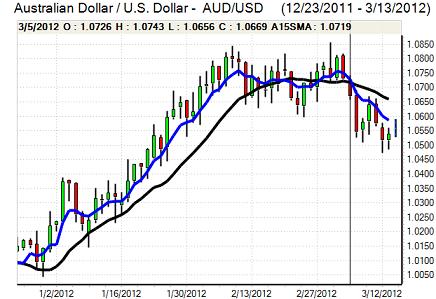

Australian dollar

The Australian dollar found support on dips to below 1.05 against the US currency on Tuesday and rallied back to the 1.0530 region ahead of the Federal Reserve announcement.

The Fed statement had a mixed impact on the currency as the impact of a firmer US currency and increased demand for North American assets was offset by gains in equity markets.

The domestic economic data was weaker than expected with a sharper than expected decline in housing starts and a drop in consumer confidence. In this environment, the Australian dollar was unable to make any headway.