By FX Empire.com

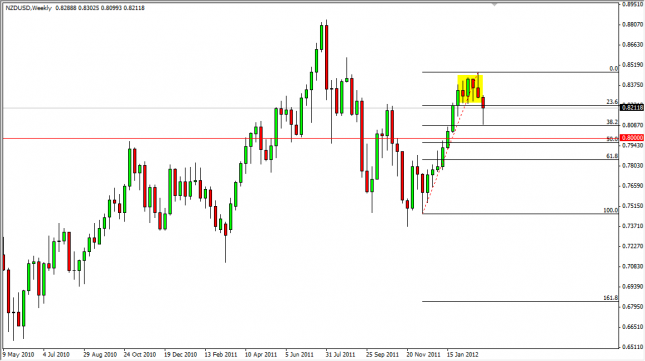

The NZD/USD pair spent much of the week falling as the “risk off” trade came back. The pair did however, bounce from the 38.2% Fibonacci retracement level as the trend continued. The commodity markets will more than likely continue to benefit from the massive amounts of liquidity in the system as central banks continue to march forward with the flooding of Dollars, Yen, and Euros into the system. With this in mind, there is no real sense that the futures markets will fall in any great amount. The 0.80 level is our “line in the sand” as we think the support there will be massive, and we won’t sell until we are below it on a daily close. The breaking of the top of the week’s range gets us long, and expecting to test the top of the recent consolidation range at the very least, and more than likely going to test the 0.88 level in the future.

NZD/USD Forecast for the Week of March 12, 2012, Technical Analysis

Originally posted here