By FX Empire.com

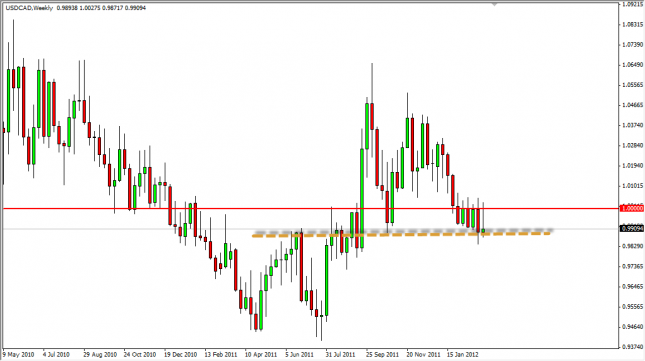

The USD/CAD pair rose for most of the week, but pulled back as the market tested and failed at the parity level again. The oil markets will always tend to have an effect on this pair, and with the higher oil levels lately – the Canadian dollar is certainly one of the most interesting currencies to own. However, it may not be in this pair.

The 1.01 level above look to be the “end” of resistance, and as such we wouldn’t buy until we get over it. However, the support lines are very tight below the current trading level. We see 0.99, 0.98, 0.9750, and 0.97 as potential supportive areas, and as such see this pair as a scalping pair at best until we get below the 0.97 level on a daily close, or above the 1.01 level. Until then, we simply don’t feel like risking the trade in this very tight market.

USD/CAD Forecast for the Week of March 12, 2012, Technical Analysis

Originally posted here