By FX Empire.com

EUR/GBP Fundamental Analysis March 12, 2012, Forecast

Analysis and Recommendations:

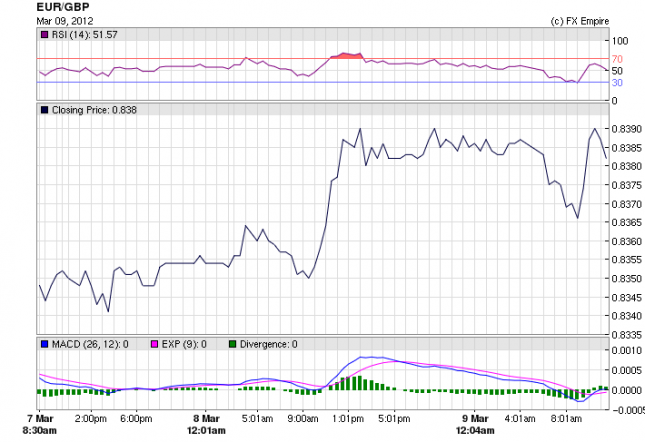

The EUR/GBP is down at 0.8366 off by 0.0020 as the euro fell against all of its partners after the completion of the Greek bond swap. New that Fitch rating services declared Greece in “restrictive default” sent the markets tumbling.

The deal is done, finally. Greece finished their debt swap with private creditors. Bondholders representing some 85% of Greece’s outstanding private-sector debt, well above the government’s minimum threshold, have agreed to the swap, easing pressures on the eurozone.

Conditions are in place for Greece to get its second bailout, said Eurogroup President Jean-Claude Juncker in a statement released Friday. “I welcome the significant progress achieved in the preparation of the second Greek adjustment program,” said Juncker, after a teleconference between euro-zone finance ministers on Friday

In the UK today, construction output fell sharply in January following a large decrease in December, figures published by National Statistics Friday showed. Construction output fell 12.3% on the month in

January, after a 11.8% monthly decline in December. Output was down 2.3%compared with January 2011. Output prices rose at their fastest since April 2011 and core inflation ticked up for the first time in five months, raising concerns over the inflationary outlook. Manufacturing output growth eased in January, following a strong rise in the previous month.

Inflation expectations for the year ahead eased back in February to 3.5% from the 4.1% seen in November, the latest Bank of England/ GfK NOP Inflation Attitudes survey shows. This was the lowest reading on this measure since August 2010.Expectations for inflation in the 12 months after that also eased back to 2.9% from 3.4% In November while longer-term inflation expectations (i.e. in 5 years time or so) fell to 3.2% from the 3.5%seen in November.

Economic Releases actual v. forecast

|

Mar. 09 |

AUD |

Trade Balance |

-0.67B |

1.51B |

1.33B |

|

CNY |

Chinese CPI (YoY) |

3.2% |

3.6% |

4.5% |

|

|

CNY |

Chinese PPI (YoY) |

0.1% |

0.0% |

0.7% |

|

|

CNY |

Chinese Fixed Asset Investment (YoY) |

21.5% |

19.6% |

23.8% |

|

|

CNY |

Chinese Industrial Production (YoY) |

11.4% |

12.4% |

12.8% |

|

|

CNY |

Chinese Retail Sales (YoY) |

14.7% |

17.4% |

18.1% |

|

|

EUR |

German CPI (MoM) |

0.7% |

0.7% |

0.7% |

|

|

GBP |

Industrial Production (MoM) |

-0.4% |

0.4% |

0.4% |

|

|

GBP |

Manufacturing Production (MoM) |

0.1% |

0.4% |

1.1% |

|

|

GBP |

PPI Input (MoM) |

2.1% |

0.7% |

0.1% |

Upcoming Economic Events

06:45 EUR French CPI (MoM)

The French Consumer Price Index (CPI) measures the changes in the price of goods and services purchased by consumers.

08:15 CHF PPI (MoM)

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation.

09:30 GBP Current Account

The Current Account index measures the difference in value between exported and imported goods, services and interest payments during the reported month. The goods portion is the same as the monthly Trade Balance figure. Because foreigners must buy the domestic currency to pay for the nation’s exports the data can have a sizable affect on the GBP.

19:00 USD Federal Budget Balance

The Federal Budget Balance measures the difference in value between the federal government’s income and expenditure during the reported month. A positive number indicates a budget surplus; a negative number indicates a deficit.

Government Bond Auction Schedule (this week)

Mar 12 10:30 Germany Eur 4.0bn new Sep 2012 Bubill

Mar 12 18:00 US Auctions 3Y Notes

Mar 13 09:30 Netherlands Eur 2.5bn-3.5bn re-opened Apr 2015 DSL

Mar 13 10:10 Italy BOT auction

Mar 13 10:30 Belgium Auctions 3 & 12M T-bills

Mar 13 15:30 UK Details gilt auction on Mar 22

Mar 13 18:00 US Auctions 10Y Notes

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here