By FX Empire.com

Rules: The interest rate differential between the European Bank(ECB) and the Swiss National Bank(SNB)

- Swiss and Euro zone fundamentals

News from the Euro and Swiss zone. EUR/CHF is frequently chosen for carry trades which involves going long a high-yielding currency (EURO – 3.50%) against a low-yielding one (CHF – 1.50%). Traders earn daily interest fees when holding this pair long (rollover fees).

EUR/CHF Weekly Fundamental Analysis March 12-16, 2012, Forecast

Analysis and Recommendations:

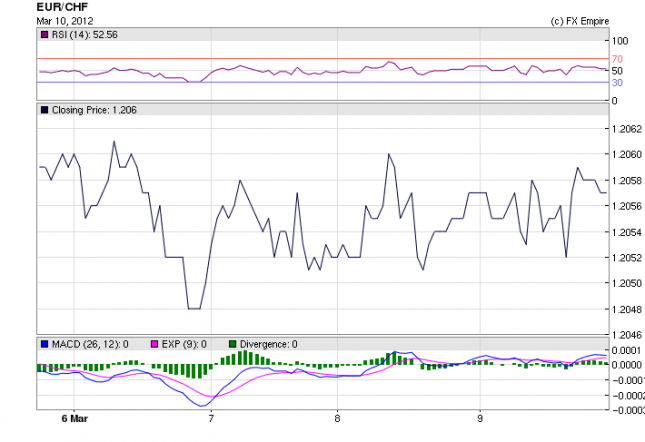

The EUR/CHF traded at 1.2058 moving up all week, as the SNB continues to assure markets that it will defend the Swissie at 1.20 levels. With another chapter closed on Greece, the euro has been able to move against its European trading partners, pushing up successful, even though it lost strength against the greenback on Friday. We should see the euro to continue upwards against the Franc this week.

Highlights of the past week

Europe

The International Swaps and Derivatives Association said Friday that the Greek government’s use of collective-action clauses, or CACs, to amend to terms of Greece-issued bonds qualifies as a “credit event” for Greece. A credit event requires a payout to those who held credit default swaps as insurance to protect them in the event of a Greek default.

The Fitch ratings agency downgraded Greece to “restricted default” over the bond swap — a move that had been expected. Fitch was the third agency to downgrade Greece into default, after Moody’s and Standard & Poor’s.

The deal is done, finally. Greece finished their debt swap with private creditors. Bondholders representing some 85% of Greece’s outstanding private-sector debt, well above the government’s minimum threshold, have agreed to the swap, easing pressures on the eurozone.

Conditions are in place for Greece to get its second bailout, said Eurogroup President Jean-Claude Juncker in a statement released Friday. “I welcome the significant progress achieved in the preparation of the second Greek adjustment program,” said Juncker, after a teleconference between euro-zone finance ministers on Friday

The Bank of England announced their current rate decision which was as expected to hold rates. No new additions to their monetary easing policies announced in February.

The European Central Bank committee held lending rates at the current rate of 1% and made no comments on any additional lending policies.

Prices for Italian government bonds jumped and Spanish bonds also rose Thursday, sending yields lower on expectations Greece will successfully complete its voluntary debt swap with private investors. Italy’s 10-year bond yield fell 0.20

German production climbed 1.6% from December. Economists were expecting an increase of 1.1% in the euro zone’s largest economy.

In the UK, house prices fell by 0.5% in February from January and were down 1.9% in the three months to February from the same period a year ago, according to the Halifax House Price Index. Prices were down 1.1% in the latest three months to February from the previous 3-month period.

EU’s Rehn: Eurozone Currently in a Mild Recession but Signs of Improvement but, risk of credit crunch in European economy has been prevented largely due to long-term liquidity offer of ECB. The Commission supports combining remaining resources of EFSF with ESM to make sturdier European firewall.

UK services sector saw growth slow in February after the surge in January, the CIPS/Markit index shows. The headline service sector CIPS/Markit index fell to 53.8 in February from an unrevised 56.0 in January, well below analysts’ median forecast for a 55.0 outturn. The detail, however, was more encouraging showing a rise in business expectations and easing inflation pressure.

Business expectations rose to their highest level for a year while output charges declined. Markit said sales were supported by discounting, with margins squeezed as input cost continued to rise.

Spanish Prime Minister Mariano Rajoy on Friday announced a new deficit to gross domestic product target for the country of 5.8% in 2012, against a prior target of 4.4%, according to media reports. Rajoy made the comments in Brussels. Spanish media has been reporting for days that the government would raise its target.

Historical

Highest: 1.5193 CHF on 10 Oct 2009.

Average: 1.3271 CHF over this period.

Lowest: 1.026 CHF on 10 Aug 2011.

The week ahead brings a vast assortment of economic indicators. A busy week with the news dominated by the US interest rate decision and inflation data.

Monday sees data on credit card lending and debt released by the RBA in Australia.

Also we have housing finance data and new car sales figures will be released. As well as the Reserve Bank of Australia will release its March quarter bulletin.

The Bank of Japan will make its interest rate decision for March.

In Europe, European Union finance ministers are scheduled to meet.

Mondaysees the United Nations economic and social council hold its annual spring meeting

The US treasury budget data will be released.

On Tuesday, the Australian Bureau of Statistics will release housing finance data for January. National Australia Bank is due to release its business confidence and conditions index for the month of February.

IN the US, the Federal Reserve hold its March meeting, where it will decide on the current level of interest rates in the country. Also January business inventories and February retail sales data are also due.

Also on Tuesday, The World Trade Centre committee on budget, finance and administration will hold a meeting.

Chinese Premier Wen Jiabao will hold his annual press briefing at the China National People’s Congress.

Wednesday sees the ABS release December housing starts data. Westpac Banking Corporation and the Melbourne Institute will release their consumer sentiment index for March.

In the United Kingdom, average earnings data for the three months to March will be released. Also February claimant count data and ILO unemployment rate figures for March will also be released.

Across the Atlantic US import and exports price data released, while current account balance data for the December quarter is due.

The weekly Energy Information Administration petroleum status report is also on tap, as well as weekly Mortgage Bankers Association mortgage applications data.

Wednesday afternoonsees World Bank deputy vice finance minister for international affairs Masatsugu Asakawa address a eurozone crisis conference hosted by the Asia Development Bank Institute.

US Federal Reserve chairman Ben Bernanke will speak at the 2012 Independent Community Bankers of America national convention

Thursday brings January lending finance data for the month of January in Australia also new car sales data for February is also set for release.

Elsewhere, the Melbourne Institute will release both its consumer inflation and employment expectation surveys for March.

Thursday morningdelivers US jobless claims data and the February producer price index in the US.

Along with several other releases in America including, The Philadelphia Federal Reserve survey and the US Treasury international capital data is on tap, alongside the New York Empire State Manufacturing Survey.

Friday brings highly anticipated consumer price index data for February in the US.

The Reuters/Michigan consumer sentiment index for March and industrial production for February data will also be released.

On Saturday, the Organization for Economic Co-operation and Development will release its interim assessment.

Economic Events in Europe this week

|

Mar. 12 |

06:45 |

EUR |

French CPI (MoM) |

|

08:15 |

CHF |

PPI (MoM) |

|

|

09:30 |

GBP |

Current Account |

|

|

Mar. 13 |

00:01 |

GBP |

RICS House Price Balance |

|

08:15 |

CHF |

Industrial Production (QoQ) |

|

|

09:30 |

GBP |

Trade Balance |

|

|

10:00 |

EUR |

German ZEW Economic Sentiment |

|

|

10:00 |

EUR |

ZEW Economic Sentiment |

|

|

Mar. 14 |

09:30 |

GBP |

Average Earnings Index +Bonus |

|

09:30 |

GBP |

Claimant Count Change |

|

|

10:00 |

EUR |

CPI (YoY) |

|

|

10:00 |

EUR |

Industrial Production (MoM) |

|

|

10:00 |

EUR |

Core CPI (YoY) |

|

|

Mar. 15 |

00:01 |

GBP |

Nationwide Consumer Confidence |

|

08:30 |

CHF |

Interest Rate Decision |

|

|

09:00 |

EUR |

Employment Change (QoQ) |

|

|

09:00 |

EUR |

ECB Monthly Report |

|

|

Mar. 16 |

08:00 |

EUR |

French Manufacturing PMI |

|

08:30 |

EUR |

German Manufacturing PMI |

|

|

09:00 |

EUR |

Manufacturing PMI |

|

|

11:00 |

GBP |

CBI Industrial Trends Orders |

Government Bond Auction Schedule (this week)

Mar 12 10:30 Germany Eur 4.0bn new Sep 2012 Bubill

Mar 12 18:00 US Auctions 3Y Notes

Mar 13 09:30 Netherlands Eur 2.5bn-3.5bn re-opened Apr 2015 DSL

Mar 13 10:10 Italy BOT auction

Mar 13 10:30 Belgium Auctions 3 & 12M T-bills

Mar 13 15:30 UK Details gilt auction on Mar 22

Mar 13 18:00 US Auctions 10Y Notes

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here