EUR/USD

The Euro was able to break through the 1.3180 resistance zone in Europe on Thursday which helped propel the currency to highs above the 1.3250 ahead of key economic events early in the US session.

There was a stream of media reports surrounding the Greek private-sector debt swap deal ahead of the deadline and there was a generally optimistic tone with reduced fears that the participation rate would be below the 75% threshold which would effectively push Greece into default.

As expected, the ECB left interest rates on hold at 1.00% following the latest council meeting and President Draghi claimed that there had been no discussion of lowering interest rates. The risks to the economic outlook were still to the downside according to the staff projections while there was an increase in the inflation forecasts. Draghi tended to concentrate on the inflation aspects early in the press conference which gave the Euro a firm tone. Although expressing confidence in the LTRO actions so far, he did express caution over the need for further action at this time. He also stated that collateral rules could be loosened much further.

There was a further decline in Italian yields during the day which helped underpin confidence in the peripheral economies and also provided some degree of Euro support.

As far as the US jobless claims were concerned, there was an increase to 362,000 in the latest week from 354,000 the previous week which maintained a general tone of optimism towards the labour market. Markets will be looking at the latest US payroll report on Friday and look for confirmation of solid employment trends.

An improvement in risk appetite curbed dollar demand and the currency was also still hampered by fresh speculation surrounding additional quantitative easing by the Federal Reserve.

There was official confirmation of the swap late in Asia on Friday with Greece securing support of 85.8% of bonds. There was disappointment that the threshold for avoiding CAC payments was not reached and the Euro retreated back to the 1.3230 region as the ISDA will meet to discuss a credit event.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 81.25 area against the yen during Thursday and pushed higher with two challenges on the 81.75 resistance region. There was a strong Euro advance against the yen with a peak near the 108.50.

There was a decline in safe-haven yen demand as equity markets rallied from losses earlier in the week and risk appetite generally improved.

A sharper than expected decline in China’s CPI inflation rate to 3.2% helped underpin risk appetite on Friday, although the impact was offset by weaker industrial data. After a brief advance to the 81.90 area, the dollar retreated to near 81.50 with some caution over extending yen selling ahead to the US employment data. Finance Minister Azumi stated that he expected the Bank of Japan to maintain an expansionary monetary policy.

Sterling

Sterling rallied against the dollar during the early part of the European session on Thursday, but it was unable to advance through the 1.5825 region and dipped to test support in the 1.5780 region before regaining ground with reports of selling from the Chinese central bank. Sterling was generally on the defensive against the Euro with a test of support near the 0.84 level.

There were no surprises from the Bank of England interest rate decision with quantitative easing left on hold at GBP325bn while interest rates were also on hold at 0.5%. Rates have now been held at 0.50% for the past three years and the minutes will be watched closely in two-week’s time to assess whether there will be support within the MPC for further quantitative easing.

Despite gaining some net support from an improvement in international risk appetite, there was further resistance above the 1.5820 area.

Swiss franc

The dollar was unable to move back above the 0.9150 area against the franc on Thursday and dipped sharply to lows below 0.91 before some degree of stabilisation. Even with a firm tone against the dollar, the Euro was trapped near 1.2050 against the Swiss currency.

Swiss consumer prices rose 0.3% in February which was slightly above expectations, although there was still a 0.9% annual decline. Although underlying deflation fears should ease slightly, especially given the strength of energy prices, the National Bank will remain on high alert. The bank stated that intervention to prevent franc gains during 2011 amounted to CHF17.8bn.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

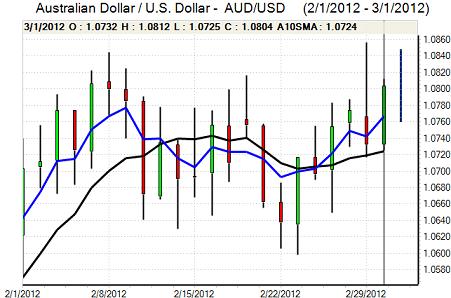

Australian dollar

The Australian dollar rallied to highs around 1.0660 against the US currency in the European session on Thursday and rallied again following a sharp retreat back to below the 1.06 level in choppy trading conditions.

The currency still found it difficult to gain strong support and tended to underperform against rival risk instruments. There was net support from an improvement in risk appetite during the day.

Domestically, there was a much weaker than expected trade account with a deficit of AUD0.67bn for January from a revised AUD1.33bn surplus the previous month.