Gold Fundamental Analysis March, 2012, Forecast

Analysis and Recommendations:

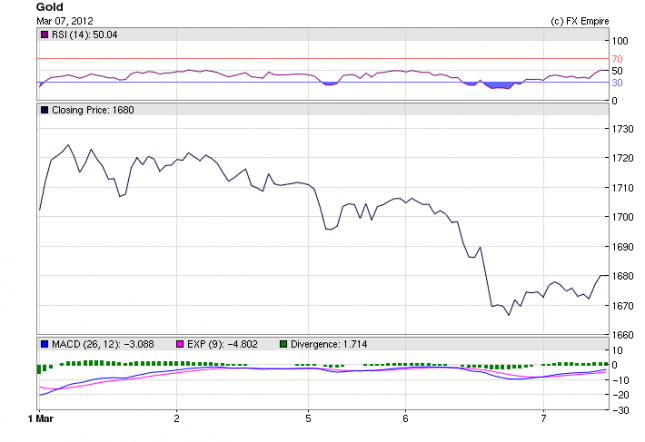

Gold bounced back up today on weakness in the USD, earlier in the day, Gold dropped as the USD was up on worries about the Greek PSI bond swap, but later in the day, after the ADP payroll report, gave such positive news, investors reached out for more riskier assets, as the dollar fell, Gold picked back up to end the session at 1688.45 up just over 16.00

Anxieties surrounding the Greek debt restructure gripped global markets. Private investors have until Thursday to participate in a bond swap with the Greek government, which is necessary for the debt-stricken nation to secure its second round of bailout funds and avert a disorderly default.

Banks’ use of the ECB overnight deposit facility came off from Monday’s record high but remained elevated, reflecting the vast amount of excess liquidity present in the banking system in the wake of the ECB’s longest-ever loans and the approaching end of the reserve period.

Banks deposited EUR816.759 billion with the ECB, the ECB said Wednesday, down slightly from Tuesday’s all-time record of EUR827.534 billion.

The Spanish government Tuesday night said the country’s regions were committed to meeting new budget-cutting targets.

Italian and Spanish government bonds rebounded Wednesday as worries about the fate of Greece’s private-sector bond swap and the potential for a messy default eased, sending yields lower. Italy’s 10-year government bond yield fell 0.09 percentage point to 4.98%. Yields move inversely to prices and a basis point is 1/100 of a percentage point.

Yields on 10-year Spanish government bonds were 2 basis points higher at 5.14%.

Australia’s fourth-quarter gross domestic product rose 0.4% against economists’ expectations of a 0.8% gain

March 7, 2012 Economic Release actual v. forecast

|

Mar. 07 |

GBP |

BRC Shop Price Index (YoY) |

1.20% |

1.40% |

|

AUD |

GDP (QoQ) |

0.4% |

0.7% |

0.8% |

|

MYR |

Malaysian Trade Balance |

8.75B |

8.20B |

8.31B |

|

JPY |

Leading Index |

94.9 |

95.1 |

93.8 |

|

CHF |

Unemployment Rate |

3.1% |

3.1% |

3.1% |

|

EUR |

Spanish Industrial Production (YoY) |

-4.2% |

-4.0% |

-3.5% |

|

TWD |

Taiwanese Trade Balance |

2.83B |

1.10B |

0.42B |

|

EUR |

German 5-Year Bobls Auction |

0.790% |

0.910% |

|

|

EUR |

German Factory Orders (MoM) |

-2.7% |

0.6% |

1.6% |

|

CLP |

Chilean Trade Balance |

1.00B |

1.98B |

|

|

USD |

MBA Mortgage Applications |

-1.2% |

-0.3% |

Just a heads up since gold is volatile and will react to most economic indicators we will begin to post the daily calendar with events that could affect the price of gold. The gold price is sensitive to a number of scheduled U.S. and Euro area macroeconomic announcements–including retail sales, non-farm payrolls, and inflation. Gold’s high sensitivity to real interest rates and its unique role as a safe-haven and store of value typically leads to a counter-cyclical reaction to surprise news, in contrast to their commodities. It also shows a particularly high sensitivity to negative surprises that might lead financial investors to become more risk averse.

These results have a number of implications. To reduce the uncertainty of the return on gold transactions, traders may wish to time their orders flow so as to avoid the release of information that has been shown to affect prices. For longer-term market participants, these results provide confirmation of the pro-cyclical bias of many commodities and gold’s role as a safe-haven during periods of economic uncertainty.

Scheduled Economic Events for March 8, 2012 (GMT)

06:30 EUR French Non-Farm Payrolls -0.1% -0.2%

French Non-farm Payrolls measures the change in the number of employed people, excluding the farming industry and government.

08:15 CHF CPI (MoM) 0.2% -0.4%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

12:00 GBP Interest Rate Decision 0.50% 0.50%

Bank of England (BOE) monetary policy committee members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

12:45 EUR Interest Rate Decision 1.00% 1.00%

The six members of the European Central Bank (ECB) Executive Board and the 16 governors of the euro area central banks vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

13:15 CAD Housing Starts 199K 198K

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

13:30 USD Initial Jobless Claims 350K 351K

13:30 USD Continuing Jobless Claims 3385K 3402K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

14:00 CAD Interest Rate Decision 1.00% 1.00%

Bank of Canada (BOC) governing council members come to a consensus on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

Sovereign Bond Auction Schedule

Mar 08 16:00 US Announces auctions of 3Y Notes

Mar 12, 10Y Notes on Mar 13 & 30Y Bonds on Mar 14

Mar 08 16:30 Italy Details BOT auction on Mar 13

Mar 09 11:00 Belgium OLO mini bond auction

Mar 09 16:30 Italy Details BTP/CCTeu on Mar 14

Originally posted here