EUR/GBP Fundamental Analysis March 6, 2012, Forecast

Analysis and Recommendations:

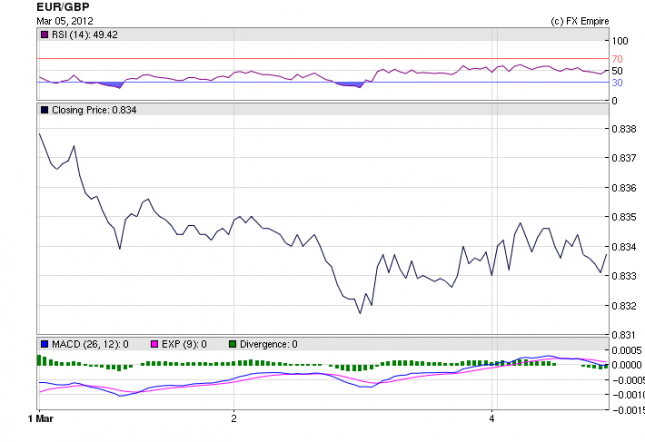

The pair EUR/GBP is currently just about at the same as the opening trading at 0.8336 holding in a tight range between .08326 and .08353. The negatives and positives in the eurozone and the UK seemed to balance against each other as the day moved on, staying in a very small trading pattern. The pair should also remain pretty constant on Tuesday as there is very little in economic data, except the worries of investors as the deadline for the Greek PSI bond swap grows near. Moving to Wednesday, the economic calendar will get busier and also the March 8th deadline for Greece to complete all of its final issues in time to avoid default.

Monday March 5, 2012 Economic Data Release actual v. forecast

|

AUD |

Company Gross Operating Profits (QoQ) |

5% |

0.3% |

4.7% |

|

CHF |

Retail Sales (YoY) |

4.4% |

2.0% |

1.7% |

|

GBP |

Services PMI |

53.8 |

55.0 |

56.0 |

|

EUR |

Retail Sales (MoM) |

0.3% |

-0.1% |

-0.5% |

In Europe

Euro zone final composite PMI falls to final 49.3 in February

Italy services PMI 44.1 in February. Down from 44.8 in January and well below Reuter’s median forecast of 45.2.

Swiss January retail sales up +4.4% y/y.

Spanish services PMI 41.9 in February. Demonstrably lower than 46.1 in January and Reuter’s median forecast of 45.9.Eighth month of contraction, lowest read since November.

In the UK

UK services sector saw growth slow in February after the surge in January, the CIPS/Markit index shows. The headline service sector CIPS/Markit index fell to 53.8 in February from an unrevised 56.0 in January, well below analysts’ median forecast for a 55.0 outturn. The detail, however, was more encouraging showing a rise in business expectations and easing inflation pressure.

Business expectations rose to their highest level for a year while output charges declined. Markit said sales were supported by discounting, with margins squeezed as input cost continued to rise.

Economic Events: (GMT)

Tuesday will be a very quiet day on the Economic Data Front. With little was due on Monday and virtually nothing on Tuesday. Keep an eye on Australia, where the RBA will be announcing rates.

10:00 EUR GDP (QoQ) -0.3% -0.3%

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

A higher than expected reading should be taken as positive/bullish for the EUR, while a lower than expected reading should be taken as negative/bearish for the EUR.

15:00 CAD Ivey PMI 62.1 64.1

The Ivey Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in Canada. A reading above 50 indicates expansion; a reading below 50 indicates contraction. The index is a joint project of the Purchasing Management Association of Canada and the Richard Ivey School of Business. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

A higher than expected reading should be taken as positive/bullish for the CAD, while a lower than expected reading should be taken as negative/bearish for the CAD.

Originally posted here