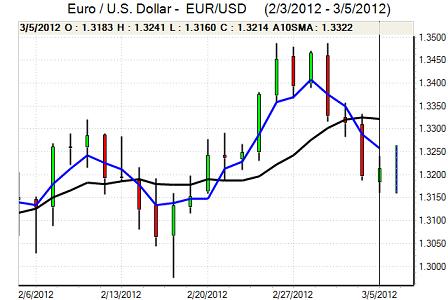

EUR/USD

The Euro remained generally on the defensive during the European session on Monday with a test of support below 1.3180 against the dollar. There was a downward revision to the final Euro-zone PMI index with a decline to 48.8 from a flash estimate of 49.4. There was a notably downbeat survey from Spain with a drop to 41.9 which increased fears surrounding peripheral economies in general and Spain in particular.

The Sentix investor confidence index was also weaker than expected, but there was some relief in the retail sales data with a 0.3% monthly increase which helped stabilise sentiment to some extent.

There was further uncertainty surrounding Greece with further speculation that the Collective Action Clauses would be triggered if there was insufficient participation in the private-sector restructuring deal with anxiety fuelled by a German industry group calling for the deal to be rejected. There were slightly more positive developments during the New York session as the IIF steering committee which oversaw the bond swap terms said it would accept the offer. There was still uncertainty over the intentions of major hedge funds.

The US ISM non-manufacturing index was stronger than expected with an increase to 57.3 for February from 56.8 the previous month, in contrast to expectations of a modest decline for the month. The data maintained a degree of confidence in the short-term US outlook and also reinforced potential US yield support in comparison with the Euro area. The employment component was slightly weaker over the month, but still signalled moderate expansion which helped underpin expectations of solid payroll growth.

There was some stabilisation in risk appetite which helped underpin the Euro and there was also some covering of short Euro positions following the currency’s ability to hold above 1.3150 support The rally stalled below 1.3250 in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

Following a retreat in Asian trading on Monday, the dollar found support just below the 81.20 level and rallied during the New York session.

The US services-sector data helped underpin US yields and also provided support for the US currency during New York trading with expectations that US growth will out-perform.

Underlying yen sentiment remained weak on expectations of further medium-term losses with expectations of strong dollar buying support on dips which curbed yen buying. Risk conditions remained slightly less favourable during Tuesday which stifled yen selling and the dollar consolidated close to the 81.50 region.

Sterling

Sterling edged lower ahead of the UK manufacturing PMI index on Monday amid rumours of a weaker than expected release. In the event, the index declined to 53.8 from 56.0 the previous month which triggered initial Sterling weakness and a 10-day low below 1.58 against the dollar. The impact was limited by selling ahead of the releases and confidence was also boosted by an advance in business expectations to a one-year high.

Later in The European session, there was some speculation that UK monetary policy could be tightened sooner than expected which provided some degree of Sterling support, although it was unable to regain the 1.59 level. Sterling maintained a strong tone against the Euro and attempted to break through resistance in the 0.8320 area which equates to 1.20 for Sterling/Euro.

Swiss franc

The dollar was blocked in the 0.9150 area against the franc on Monday and edged weaker to the 0.9110 area during the US session as ranges narrowed. There was little in the way of Euro movement against the Swiss currency as it remained trapped in the 1.2060 area.

There was 4.4% growth in retail sales in the year to January from a revised 1.7% previously which maintained cautious optimism over the economic outlook. Immediate demand for the franc may decline slightly if the Greek debt-swap deal is approved, although there will inevitably be caution given doubts over the ECB’s policies.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

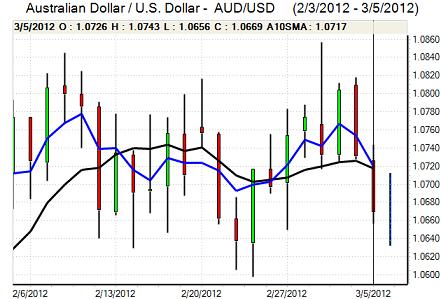

Australian dollar

The Australian dollar continued to drift lower during Monday, weighed down by unease surrounding the Euro-zone growth outlook as well as the downgrading of China’s official GDP growth target to an eight-year low. The currency retreated to the 1.0660 area, although selling pressure was contained.

As expected, the Reserve Bank of Australia left interest rates on hold at 4.25% following the latest policy meeting. The bank did state that it was prepared to cut rates if there was evidence of a sharp weakening in demand conditions. The bank’s tone had some negative impact of the Australian dollar with the currency retreating to lows near the 1.06 level against the US currency.