EUR/USD

The Euro maintained a firm tone ahead of the ECB long-term refinancing operation (LTRO) on Wednesday. Further gains for the currency were curbed to some extent by a weaker than expected German unemployment report as the total failed to decline for the first time since November.

The ECB announced that EUR530bn was allocated in the second LTRO operation which was marginally higher than expected and compared with a EUR489bn figure last time. There was a surprise in the number of banks which took part as more than 800 institutions took funds in the operation from 500 last time. The further aggressive provision of liquidity helped maintain risk appetite initially, but there was a more cautious tone later in the session.

There were some fears that the substantial number of banks taking part suggested that more banks were facing funding stresses. The Euro was also undermined by the quasi quantitative easing and by further doubts surrounding the banks balance sheet and the exposure to bad debts. There was also a sharp rise in Portuguese bond yields.

The US economic data was slightly stronger than expected with fourth-quarter GDP revised up to 3.0% from 2.8% previously. The Chicago PMI index rose to 64.0 for February from 60.2 previously and the Fed’s Beige Book reported that growth was modest to moderate in most districts.

Comments from Fed Chairman Bernanke were watched very closely, especially with quantitative easing an important international focus. The Fed Chief was slightly more optimistic surrounding the economic outlook with comments that unemployment was falling faster than expected. Bernanke maintained that an aggressive and expansionary monetary policy was justified, but he also stated that there was no immediate case for a further expansion of quantitative easing.

These comments helped the dollar gain ground strongly and the Euro retreated back to the 1.3320 area. There was also a sharp decline in gold prices during the New York session.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was able to resist a further test of support in the 80 area against the yen during Wednesday and, after an initial period of consolidation, the currency pushed sharply higher during the New York session.

The dollar drew initial support from the stronger than expected GDP data and momentum accelerated following Fed Chairman Bernanke’s comments which downplayed the potential for further quantitative easing. With wider US currency support, the yen dropped to lows near 81.30.

The Japanese investment data was stronger than expected with a 7.6% annual increase in capital spending which should trigger an upward revision to GDP estimates. Wider risk appetite was supported by a slightly stronger than expected Chinese PMI report which curbed yen demand.

Sterling

Sterling was resilient against the dollar in the European session on Wednesday and briefly pushed to highs near 1.60 before retreating later in New York. There was strong action on the crosses as the Euro came under heavy selling pressure, dipping to lows around 0.8365.

The latest UK economic data was stronger than expected as mortgage approvals increased to a two-year high of 59,000 while consumer net lending was also significantly stronger than expected. There will also be some Bank of England relief that there was an expansion in money supply growth in the latest data.

There were inevitably mixed comments in Bank of England parliamentary testimony on the inflation report. Governor King remained very anxious surrounding bank capital levels, but also stated uncertainty surrounding further quantitative easing. Tucker and Bean expressed some concerns over the inflation outlook and Weale was more forthright instating that he did not see the case for further easing which provided some Sterling support.

Swiss franc

The dollar found support below 0.8950 against the franc on Wednesday and secured strong gains from the early US open and pushed to highs of 0.9050 on wider gains for the US currency. The Euro was trapped near the 1.2050 level with very narrow ranges which suggested that the National Bank may have been intervening to prevent Euro gains.

The latest Swiss KOF index was little changed with an improvement to -0.12 from -0.15 previously as companies remained uneasy over the outlook. Swiss confidence has lagged behind Germany over the past few months which will maintain competitiveness fears.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

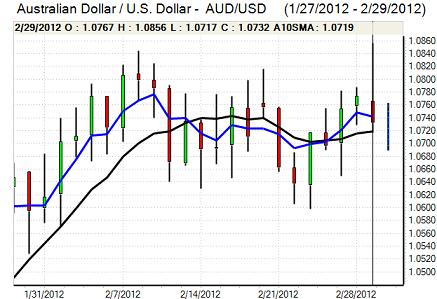

Australian dollar

The Australian dollar held a firm tone ahead of the ECB LTRO operation on Wednesday and initially held the gains as the Euro was sold heavily on the crosses. The Australian dollar was unable to sustain the gains and dipped sharply to lows below 1.0720.

Although risk appetite held relatively firm, there was a decline in equity markets and the currency was undermined by a very sharp decline in gold prices. Weaker than expected data for building approvals and construction spending offset the positive impact of a firmer than expected Chinese PMI release and the Australian dollar hit resistance close to the 1.0780 area.