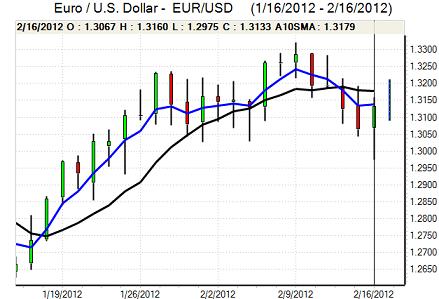

EUR/USD

The Euro remained under pressure in European trading on Thursday with a retreat to below the 1.30 level against the US dollar. There were further concerns surrounding the Greek debt situation which undermined the currency as markets remained uneasy surrounding the risk of a disorderly debt default as underlying tensions continued.

The US data maintained a generally firm tone during the day with jobless claims falling to 348,000 in the latest week from 361,000 the previous week, maintaining the generally firm tone seen in recent labour-market data. There was a small increase in housing starts with permits unchanged over the month. The Philadelphia Fed index rose to a four-month high of 10.2 for February from 7.3 previously.

Fed Chairman Bernanke made only limited comments surrounding monetary policy in a speech on Thursday, but he did express confidence that an accommodative monetary policy would have a positive impact on the economy. Expectations of a loose monetary policy maintained a generally negative tone towards the dollar.

The Euro found support below the 1.30 level with some reports of central bank buying and the currency rose strongly during the New York session. There were greater hopes that there would be a Greek debt agreement by Monday which boosted confidence to some extent as political leaders looked to soothe tensions.

The ECB also announced that it was swapping its existing Greek bonds for new holdings issued by Greece. The bank stated that it would not make a profit on the holdings and the announcement was generally well received. There will, however, be the risk of a legal challenge by other bond holders who could claim that Greece was receiving favourable treatment and uncertainty remained extremely high. In this environment, the Euro pushed back to the 1.3130 area in choppy trading conditions.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support below 78.50 against the yen during Thursday and advanced again during New York trading with a move to fresh 15-week highs near the 79 level.

The US currency gained support from an improvement in yields following the latest economic data, especially with a sustained improvement in the labour-market data.

The latest Bank of Japan minutes from January reported an extended discussion on causes of yen strength. Bank Governor Shirakawa stated that it will be a long process to reach the 1.0% inflation goal and pressure to weaken the yen will continue.

The yen also retreated on the crosses as the Euro moved to fresh 3-month highs near 104.00 as buying support for the yen was undermined by an improvement in risk appetite and the dollar tested resistance above 79 for the first time since Bank of Japan intervention in October.

Sterling

Sterling found support in the 1.5660 area against the dollar during Thursday and rallied strongly to the 1.58 area during New York trading as US moves dominated.

There were no major UK data releases during the day with markets still debating the potential for additional quantitative easing. The increase in inflation forecast in the quarterly Bank of England report has dampened expectations of further central-bank action, but there is still a high degree of uncertainty.

The UK currency gained some net support from an improvement in risk appetite and there was some initial evidence of flows into Sterling as a safe-haven from the Euro area. The UK currency, however, was unable to sustain a move beyond 0.83 against the Euro.

Swiss franc

The dollar maintained a strong tone in European trading on Thursday and pushed to highs close to 0.93 against the franc ahead of the New York open. The dollar was unable to sustain the gains and dipped sharply to lows below 0.92 as volatility remained high. The Euro was trapped in narrow ranges against the Swiss currency.

The franc proved broadly resilient in the face of an improvement in risk appetite as persistent uncertainty surrounding the Greek situation sapped any flow of funds out of the franc. There was also unease over the risk of big Euro-zone policy announcements over the weekend which could trigger substantial franc buying on Monday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

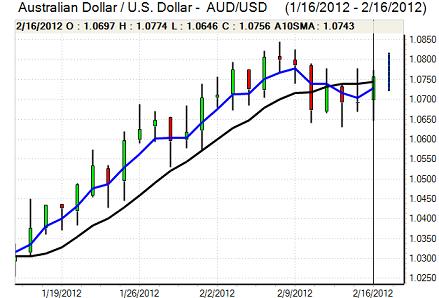

Australian dollar

The Australian dollar found support just above the 1.0650 area against the US dollar during Thursday and rallied firmly during the US session as markets were again frustrated in attempts to break out of recent ranges.

As risk appetite improved, the Australian currency rallied to highs just above the 1.0750 level with a test of resistance near 1.08 in Asia on Friday as funds looked to trigger stop losses. There were no significant domestic developments as markets continued to monitor the Euro closely for near-term direction.