We start our discussion by defining the term Coffee first and learning more about it, if you are not familiar with what it’s all about.

Coffee is a brewed beverage with a dark, acidic flavor prepared from the roasted seeds of the coffee plant, colloquially called coffee beans. The beans are found in coffee cherries, which grow on trees cultivated in over 70 countries, primarily in equatorial Latin America, Southeast Asia, South Asia and Africa. Green (unroasted) coffee is one of the most traded agricultural commodities in the world. It is one of the most-consumed beverages in the world.

Of the two main species grown, arabica coffee (from C. arabica) is generally more highly regarded than robusta coffee (from C. canephora); robusta tends to be bitter and have less flavor but better body than arabica. For these reasons, about three-quarters of coffee cultivated worldwide is C. arabica.Robusta strains also contain about 40-50% more caffeine than arabica. For this reason, it is used as an inexpensive substitute for arabica in many commercial coffee blends. Good quality robusta beans are used in some espresso blends to provide a full-bodied taste, a better foam head (known as crema), and to lower the ingredient cost.

Because of these different varieties, there is more than Coffee futures exchange throughout the world.

Arabica coffee futures and options are traded in New York on the ICE. The size of the Coffee “C” futures contract is 37,500 pounds. The contract prices physical delivery of exchange-grade green beans from one of 19 countries of origin in a licensed warehouse to one of several ports in the United States and Europe. Note that the 3 of the largest producers in the world (Brazil, Vietnam and Indonesia) are not deliverable against this contract currently.

Robusta coffee futures are traded in London on Euronext.liffe. The size of this coffee futures contract is 10 metric tons. Coffee futures prices are quoted in U.S. dollars per metric ton with the minimum price movement $1 per ton or $10 for the contract. All Robusta coffees are deliverable from all origins against this contract.

Other international exchanges that trade coffee futures include the Singapore Commodity Exchange (Robusta), the Commodities & Futures Exchange (BM&F) in Brazil (Arabica) and the Tokyo Grain Exchange (Arabica and Robusta).

Now let’s cover more recent news and updates on the market.

The last USDA report on coffee released in December 2011 showed still a fairly tight ending stocks scenario for the world market.

| Producing Country | Production (mln 60 kg bags) |

| 1) Brazil | 49.2 |

| 2) Vietnam | 20.6 |

| 3) Colombia | 8.5 |

| 4) Indonesia | 8.3 |

| 5) India | 5.2 |

| Total | 133.81 (or 8.0286 mln tons) |

| Consuming Country | Consumption (mln 60 kg bags) |

| 1) EU-27 | 46.5 |

| 2) U.S. | 23.9 |

| 3) Brazil | 19.8 |

| 4) Japan | 7 |

| 5) Russia | 4.2 |

| Total | 133.86 (or 8.0316 mln tons) |

| Crop Year | Stocks to Use Ratio |

| 2011/12 | 17.90% |

| 2010/11 | 19.60% |

| 2009/10 | 19.90% |

| 2008/09 | 29.90% |

| 2007/08 | 22.90% |

So from this scenario, we could see coffee prices climb higher. Well, let’s keep in mind the sensitivity of consumption to the recent geo-political headlines. If the 2 largest consumers of coffee in the world are Europe and the U.S., then we will see the coffee market influenced by current Eurozone crisis of course and any negative economic data that might come out on the U.S.

Today, the Arabica coffee futures did fall quite a bit (4.25 %) based on economic data released this morning regarding the retail sales which were below expectations. Moreover, Moody’s also cut the debt ratings of six European countries as well today.

On the other hand, the Robusta coffee futures have actually been rallying the in the last few days and is inverted due to limited export supplies. Vietnam’s coffee exports were 112,182 tons in January, down 48 percent from a year earlier, according to the country’s General Customs Department. “Vietnam, the only volume supplier of robusta at the moment, is a good but disciplined seller, and demand is constant,” Volcafe, the coffee unit of commodities trader ED&F Man Holdings Ltd., said in a report e-mailed last week.

We still have a few months before some other major producers and exporters come online to offer new crop supplies. The harvest in Brazil, the second-biggest grower of robusta beans, usually starts in July, data from the U.S. Department of Agriculture show. The crop in Indonesia, the world’s third- largest producer of robustas, starts in April, the USDA says.

Therefore, we think that because of the robusta market staying very strong recently, that it will lead the way for the Arabica Market to higher levels and narrow spreads going into March / April. One should recall that in the past 4 years there has been a rally in coffee futures and narrowing spreads going into Brazilian harvest due to concerns of frost damage, etc. Although there are forecasts now for the Brazilian coffee crop reaching 50.0 mln bags, if there is any frost damage (or scare of) during their harvest, then the market will rally quite violently as stocks to usage ratio is still very tight and the market needs all the supply it can get.

The way we recommend to play this strategy is in the spreads as coffee futures are very volatile regularly.

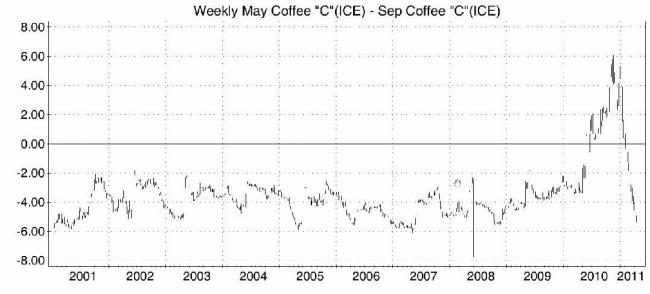

Let’s look at the May / Sept spread in Coffee over the past 15 years (using MRCI data):

We see that from the above chart, the spread has rarely traded below a 6 cent carry. Current market is as follows:

The market currently settled at approx. 6 cent carry. Although this trade might stay still for a while, it looks to have limited downside historically. This is the strategy that we use to play this bullish scenario in coffee.

Please contact Edgard Cabanillas via email – edgard@commoditypage.com, or telephone 949-943-3705

**There is risk of loss in trading commodities. Only risk capital should be used. Losses from commodity investments may be greater than the initial investment(s). Commodity trading is not appropriate for all investors, and a commodity investment must be evaluated in light of the potential for risk of loss as well as the possibility of profit. **