We featured the chart below in yesterday’s issue but we are going to run it again today as we attack the markets from a slightly different perspective. The inspiration for this particular ramble comes from our head-shaking reaction to the comments from a well-known major-dealer markets strategist in yesterday’s financial press. We will not mention names, firms, or include quotes but the idea was that the equity markets were going to remain in a trading range because… strong stock markets require weak bond markets and… we will not get a weak bond market until the Fed starts to raise the funds rate which… won’t happen until some time late in 2014.

Our reaction to this particular argument might best be described as stunned disbelief. How does one become a Wall Street markets strategist without having the slightest clue about how the markets actually work?

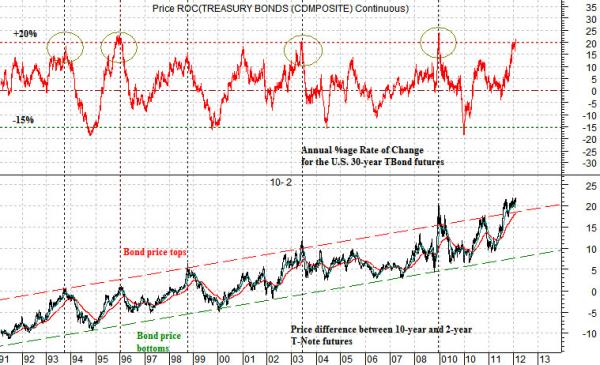

Below is our comparison between the price spread or difference of the 10-year and 2-year Treasury futures (10- 2) and an annual Rate of Change (ROC) indicator for the 30-year T-Bond futures.

Based the trend over the past couple of decades it is probably fair to argue that we are at or close to a bond price peak when two things happen. First, when the price spread between the 10-year and 2-year Treasury futures rises to or through the channel top… bond prices are toppy. Second, when the 30-year T-Bond futures rise to around 20% higher on a year-over-year basis… bond prices are toppy.

When both instances occur at the same time- as is the case at present- then the odds of this being a bond market price peak are reasonably high. In past cycles similar readings have led to bond price ‘bears’ over the next 12 to 15 months with the next bottom tending to occur when the TBond futures fall to -15% year-over-year. Fair enough.

What wound us up today was not the observation that the equity markets would remain in range bound until bond prices started to turn lower (because that is generally true) but rather the observation that long-term bond prices will not decline until the Fed starts to raise the funds rate.

Let’s take a look at a couple of recent examples to show what we mean.

At top right is a comparison from 1999- 2001 that shows 10-year Treasury yields and the Fed funds target rate.

If long-term yields move with short-term yields and the entire yield curve is driven by changes in the funds rate… then one would logically expect to see 10-year yields tumbling in 2001 AFTER the Fed started to cut the fund rate. But… that was most certainly NOT the case.

Our argument is that the bond market leads and the Fed follows. Not the other way around. The Fed changes the funds rate when the markets tells it to do so. Not the other way around.

The chart quite clearly shows that 10-year yields peaked in January of 2000 while the first Fed rate cut took place 12 months later in January of 2001.

The comparison makes two intriguing points. First, the bond market began discounting an economic slow down a full year before the Fed noticed that something had changed. Second, buying bonds on the Fed rate cut in January of 2001 at a 10-year yield of around 5.0% wouldn’t have been the worst trading decision but, even then, five months later yields had risen to 5.5%.

Below right is a comparison from 2003 through 2004 of 10-year Treasury yields and the Fed funds target rate.

In this example we are looking at the start of Fed credit tightening (i.e. a rising funds rate) instead of the previous example of Fed credit easing (i.e. falling funds rate).

The low point for 10-year yields was reached in mid-2003. 12 months later the Fed started to raise the funds rate. Once again the long end of the bond market was discounting an economic change a full year before the first policy adjustment by the Fed.

So… if the argument was that stock prices will rise when bond prices decline- which has most certainly been the case post-1998 in the U.S. and post-1990 in Japan- then our counter is that this has nothing to do with what the Fed actually does (because the Fed lags the bond market by a full year) and is even less relevant (if that is possible) to what the Fed ‘says’ it will do. Why? Because the Fed has absolutely no idea at this point in time when it will start to raise the funds rate. None.

Our view is that the first Fed rate hike will come about a year after long-term Treasury yields start to trend higher. In fact we have argued that the first Fed funds rate increase will take place on the meeting following a rise in 3-month TBill yields through the top end of the Fed’s target range for over night funds. Based on past examples that will take about a year from the ‘go’ point. On the next page we will look at two comparisons that might help us determine when the clock will start ticking.