EUR/USD

The Euro challenged resistance levels above 1.3050 against the dollar in Europe on Tuesday before being subjected to sharp losses in choppy trading conditions.

The Euro secured initial support from the latest flash PMI data which recorded an increase in the manufacturing component to 48.7 from 46.9 previously while the services-sector index moved above the 50 level for the first time since the August 2011 release. The data maintained the run of more favourable data seen over the past few weeks and helped ease immediate fears surrounding the Euro-zone outlook, although the Euro area was still dependent on the core economies as peripheral demand remained weak.

There was further debate surrounding the Greek private-sector debt deal with a suggestion that a new arrangement could be in place by the middle of February. Nevertheless, there was further unease surrounding the situation as default fears intensified with Standard & Poor’s indicating that any agreement was likely to be considered a default. There was also some further risk of contagion as Portuguese yields continued to increase.

There was further caution ahead of Wednesday’s Federal Reserve FOMC meeting, especially with interest rate projections set to be released for the first time. There was further speculation that the Fed would maintain a very dovish profile in the forecasts and the dollar could be exposed to further selling pressure if it appears likely that rates will be held at exceptionally low levels for even longer. The US currency should gain some relief if there are no suggestions of further quantitative easing.

Underlying risk appetite remained firm which helped curb underlying dollar demand on defensive grounds and rising German bond yields also helped underpin the Euro. In this environment, the Euro found support in the 1.2950 area and rallied back to challenge resistance levels above 1.30.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar initially moved above resistance in the 77 area against the yen on Tuesday and, after an initial move to the 77.35 area faded, there was a fresh surge in dollar buying early in the US session which ultimately pushed the dollar to near the 78 level for the first time in a month.

There was speculation that Japan would run a trade deficit for 2011 and this was confirmed in the latest data release on Wednesday with the first annual deficit for 16 years as exports declined by 8% over the year. This undermined yen sentiment on fears over a structural deterioration.

Underlying risk appetite also remained firmer during the day which helped curb defensive yen demand and the Euro was able to recover to the 101.50 area against the Japanese currency.

Sterling

Sterling found support on dips to just below 1.5550 against the dollar on Tuesday and rallied to highs near 1.5620 as the US currency was generally on the defensive.

The headline public-sector borrowing requirement was better than expected with a figure of GBP10.8bn for December from a revised GBP15.1bn previously. The market focus tended to be on the level of debt which rose above the GBP1trn level for the first time, but the negative Sterling impact was limited.

Bank of England Governor King remained cautious over the economic outlook with a warning that bank lending would remain weak. He also stated that lower inflation would give the bank scope to provide additional quantitative easing if necessary. King, however, was notably less fearful in his general comments on the economy compared with his tone late in 2011 which helped support Sterling.

Swiss franc

The dollar found support on dips to below 0.9250 against the franc on Tuesday and rallied to the 0.93 area, but was unable to overcome resistance in this area. There was a significant Euro recovery to the 1.21 area after support above 1.2050 held.

In comments on Tuesday, National Bank member Danthine reiterated that the bank would defend the minimum Euro level with the utmost determination and would block franc gains with unlimited buying of overseas currencies if required. The bank’s determination deterred market attempts to attack the Euro minimum level, especially as international risk appetite was generally firmer.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

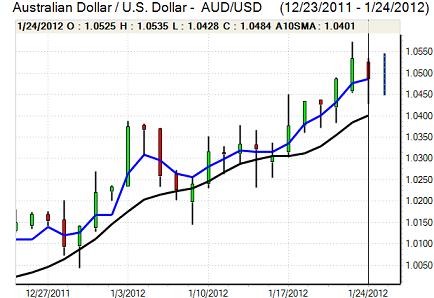

Australian dollar

The Australian dollar dipped to test support below 1.0450 against the US dollar on Tuesday before rebounding to re-test resistance levels. International risk appetite remained firm during the day which helped underpin the Australian currency as global growth fears eased slightly, although there was a downgrading of growth forecasts from the IMF.

The latest headline domestic consumer prices data was weaker than expected with prices unchanged for the fourth quarter. The underlying data was stronger than expected with a 0.6% quarterly increase and this had an important impact in reversing sentiment and the Australian dollar rebounded to test resistance above the 1.05 level late in the Asian session.