EUR/USD

The Euro again hit resistance in the 1.2780 area against the dollar on Wednesday and was subjected to renewed selling pressure ahead of the US open as underlying sentiment remained negative towards the currency.

There were further concerns surrounding Greek debt-restructuring talks with reports that negotiations were close to deadlock as there was heavy resistance to calls for a larger private-sector debt restructuring. There were further concerns that continued acrimony would increase the risk of Greece being pushed towards a hard default.

There were comments from ratings agency Fitch that the ECB needed to do more to prevent a cataclysmic collapse of the Euro which pushed the Euro sharply lower and there were further rumours surrounding a French credit-rating downgrade by Standard & Poor’s in rumour-driven trade.

There was further speculation that the Euro would be used as a funding currency. There will be pressure for further ECB action at Thursday’s policy meeting. Although the bank will be reluctant to cut interest rates again so quickly after cuts at the last two meetings, it may signal that it is willing to cut rates again later this quarter which would encourage further Euro selling on yield grounds.

The US Federal Reserve Beige book reported further modest growth over the past few weeks which maintained expectations of US out-performance in the short term and this did provide background dollar support. The Euro re-tested lows around 1.2660 against the dollar before regaining the 1.27 area in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar nudged above the 77 level against the yen on Wednesday, but it was unable to sustain the gains and weakened back to the 76.85 area. The Japanese currency maintained a solid tone on the European crosses as the Euro re-tested 11-year lows below 97.50 while Sterling also weakened to below 118 level for the first time since last October.

China’s inflation data was marginally above expectations at 4.1% for December, but the regional currency impact was limited. There was some optimism surrounding the global growth outlook, especially with generally favourable US data releases. The dollar still found it difficult to gain additional yield support and the yen was also broadly resilient as there was still a reluctance to sell the yen aggressively.

Sterling

Sterling was unable to make a fresh attack on resistance in the 1.55 area against the dollar on Wednesday and was subjected to renewed selling pressure with particularly sharp losses ahead of the US open as the UK currency tested support near 1.53. Sterling lost momentum against the Euro and retreated to lows just beyond the 0.83 level.

The UK trade data was slightly worse than expected with a GBP8.6bn goods deficit for November from a revised GBP7.9bn previously. The impact was limited as there should still be a narrower deficit for the fourth quarter as exports made some headway.

The Bank of England will announce its latest interest rate decision on Thursday and markets are not expecting further action by the MPC at this stage, especially as recent business surveys have been generally mixed while the bank has also indicated that it wants to wait until the current round of asset purchases are competed in February before considering any additional measures. Sterling will be vulnerable to sharp losses if there is an announcement of further quantitative easing.

Swiss franc

The dollar found support on dips to below 0.95 against the franc on Wednesday and pushed to highs just above 0.9550 before stalling. The Euro cross remained an important focus as it tested support levels near 1.21. This remains a potentially very important level given the National Bank’s focus on preventing further gains as any dip to below 1.21 could trigger heavy stop-loss franc buying.

The Finance Ministry reiterated that it had no direct powers over the central bank and markets continued to speculate whether the central bank would maintain the minimum Euro level following Chairman Hildebrand’s resignation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

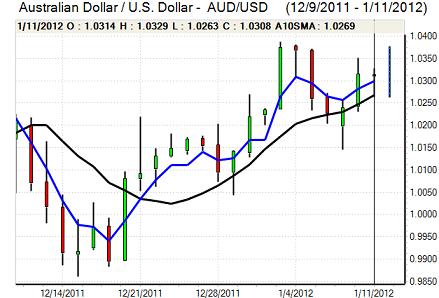

The Australian dollar hit resistance close to 1.0320 against the US currency on Wednesday and dipped sharply to lows around 1.0260 before regaining some support. In general, the Australian currency was still broadly resilient due to hopes that the global economy could avoid a severe slowdown this year as US spending provided support. This also encouraged some interest in carry trades funded through the Euro.

There is still likely to be underlying caution given the risk of a sharp slowdown in China and there will also be unease surrounding the banking sector which will maintain underlying caution.