EUR/USD

The Euro continued to find support in the 1.27 area against the dollar on Monday and pushed to a high in the 1.2780 area before losing momentum. The currency remained over-sold following recent sharp losses and this helped trigger a recovery on technical grounds.

The latest positioning data also suggested that the US currency was at its most over-bought since the first quarter of 2010 and this also led to caution over further dollar buying.

The latest Sentix business confidence index recorded a recovery to -21.1 for December from -24 previously and the German industrial production data was broadly in line with expectations with a 0.6% monthly decline. There was still a high degree of unease surrounding the Euro-zone banking sector, especially as Italian banks’ dependence on the ECB for funding increased sharply for December. There was also a record amount of funds parked at the ECB which continued to suggest very little confidence in the sector.

The latest German auction for six-month bills registered healthy investor interest. The main feature was that yields were actually negative for the first time. Although there was a technical change, the fact that investors were prepared to pay to hold German securities also illustrated the break-down in trust.

There were further concerns surrounding the Greek outlook with speculation that higher debt write-downs would be needed to provide any hope of medium-term stability. There were persistent doubts whether any agreement could be secured and speculation over a Euro exit increased again. German Chancellor Merkel and French President Sarkozy pledged to push ahead with the fiscal compact, although the overall market impact was limited.

The latest US consumer credit data was much stronger than expected with a US$20bn increase for November which helped maintain near-term confidence surrounding the US spending outlook. The Euro managed to resist fresh losses and maintained a firmer tone in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 76.80 area against the yen during Monday, but was unable to make any significant headway as it was blocked below 77. Although the yen was unable to make further gains on the crosses, corrections were limited as the currency maintained a solid tone.

The solid tone of US data releases underpinned the dollar to some extent with the impact still lessened by the fact that there is no realistic prospect of any near-term Fed tightening.

Global risk appetite has been able to stabilise which may curb aggressive yen support, but sentiment remains very fragile and there is a reluctance to push funds out of Japan while repatriation from Europe also remains a threat.

Sterling

Sterling found support on dips towards 1.54 against the dollar on Monday in choppy trading and pushed to a high near 1.5480 as the US currency retreated. Sterling drifted weaker from an over-bought position against the Euro.

The latest UK data release were slightly better than expected with the RICS house-price index improving to -16% for December from -17% previously. There was also a stronger than expected reading for the BRC retail sales report with a 2.2% increase in the year to December which may ease immediate fears surrounding retail spending, although uncertainty will remain very high.

There will be the potential for defensive inflows into Sterling as Euro-zone fears remain at elevated levels with further potential buying of UK bonds. There will be some caution ahead of Thursday’s Bank of England monetary policy meeting given the slight possibility of further action to expand quantitative easing.

Swiss franc

The dollar was unable to make a move beyond 0.9550 against the franc on Monday and retreated to test support below 0.95 as volatility spiked higher.

Ahead of scheduled parliamentary testimony, National Bank Chairman Hildebrand resigned due to the damage being caused to the bank’s reputation by the allegations surrounding currency transactions by his wife. The Euro came under pressure and dipped to lows near 1.21 on speculation that the bank will now be less committed to the minimum 1.20 Euro level. This will increase the possibility of the 1.20 level being tested over the next few days and volatility is liable to remain higher as the bank would be forced to respond.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

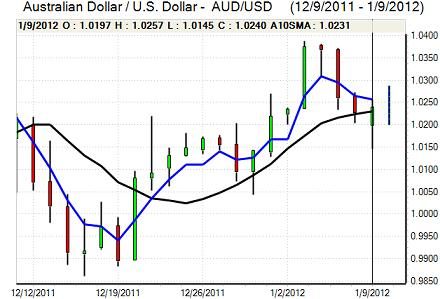

Australian dollar

The Australian dollar found support in the 1.0180 area on Monday and pushed steadily higher with a peak near 1.03 during the Asian session on Tuesday.

The domestic data was stronger than expected which helped underpin sentiment with an 8.4% recovery in building approvals following a revised 10.0% decline the previous month.

International risk appetite was resilient which helped underpin sentiment and the currency also gained some support from a higher than expected Chinese trade surplus for December which underpinned trade hopes. There was still an underlying mood of caution which limited the potential favourable impact.