EUR/USD

The Euro was unable to push above the 1.2930 area against the dollar in Europe on Thursday and, in a similar pattern from the previous day, it was then subjected to sustained selling pressure as Euro-zone fears continued to permeate markets.

The latest French bond auction recorded a small increase in yields compared with the previous sale in December and bidder interest was generally lacklustre. Although by no means a disaster, the auction reinforced an underlying lack of confidence.

There were further concern surrounding the Euro-zone banking sector with a further sharp decline in Unicredit’s share price as well as rumours of capital raising by Deutsche Bank. There were concerns surrounding provisions in the rights issue to guard against the possibility of Euro break-up and this further unsettled market confidence. There were also further concerns surrounding Greece with warnings over the severity of the situation from the Prime Minister and reports that troika talks could be delayed. There were also further fears surrounding a contagion threat from Hungary.

The US ADP employment data was significantly stronger than expected with a reported increase of 325,000 for December from a revised 204,000 the previous month while jobless clams also fell to 372,000 in the latest week from 387,000. Although the correlation between the two is inconsistent, there was increased optimism surrounding Friday’s monthly payroll data.

Although there was some disappointment surrounding the ISM services-sector index with a reading of 52.6 from 52.0 previously, underlying optimism remained intact. In this context, there was evidence of a significant divergence as the dollar tended to gain support from stronger than expected data, in contrast to much of the second half of 2011 when the US currency lost ground against the Euro when risk appetite improved.

The Euro remained under general pressure and dipped to lows below 1.28 against the US currency with further selling pressure in Asia on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 76.70 area against the yen on Thursday and pushed significantly higher during the day. The Euro proved slightly more resilient against the yen that the dollar and technically this did have an impact in pushing the US currency higher.

The US growth indicators were also significant and the dollar did finally manage to gain some support on yield grounds as expectations of US out-performance were sustained. The US employment data had a particularly important impact in pushing the US currency higher.

There were further serious concerns surrounding the Euro-zone outlook and this had an important impact in curbing any selling pressure on the yen as capital repatriation was still an important threat.

Sterling

Sterling hit selling pressure above 1.56 against the dollar on Thursday and had a consistently weaker tone as it tested support below 1.55. In contrast, the UK currency maintained a firm tone on the Euro an advanced to fresh 16-month highs beyond 0.8250 with confidence helped by the fact that GBP/EUR was able to hold above the 1.20 level.

The PMI services-sector index was stronger than expected with a reading of 54.0 for December from 52.1 previously and all three PMI readings were stronger than expected. Although there was caution surrounding the outlook, the data triggered some reassessment of the immediate UK recession risks and this was also important in supporting Sterling.

The Bank of England warned that credit conditions were liable to tighten further and there will also be further concerns surrounding the consumer spending outlook. Sentiment could reverse rapidly given the precarious condition of the UK economy.

Swiss franc

The dollar found support above the 0.94 level against the US currency on Thursday and pushed sharply higher during the day with a peak just below 0.9550 in Asia on Friday. Although wider US gains were the primary trigger, the franc was also unable to make any headway against the Euro with reports of aggressive central bank franc sell orders near the 1.2150 area.

National Bank President Hildebrand held a news conference relating to compliance issues and insisted that there would be no resignation surrounding alleged currency trading by his wife. The immediate currency impact was limited despite some speculation that the President’s longer-term position was compromised.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

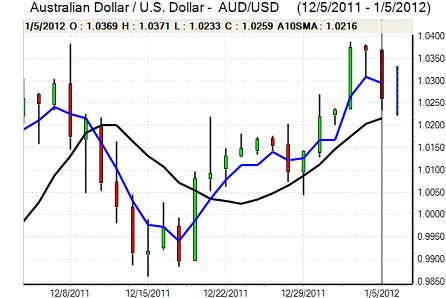

Australian dollar

The Australian dollar was unable to hold above 1.03 against the US currency on Thursday and dipped sharply to lows near 1.02 in local trading on Friday.

There were general gains for the US currency which undermined the Australian dollar, although the currency was broadly resilient on the crosses. The stronger than expected US data also helped underpin sentiment towards the global economy which curbed selling pressure on the currency. The Asian economic outlook will continue to have an important impact on underlying confidence.