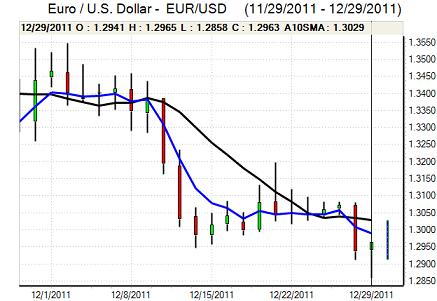

EUR/USD

The Euro was unable to make any headway during the European session on Thursday with markets tense ahead of the latest Italian debt auction.

The authorities managed to get the auction away and 10-year yields moved slightly below the 7.0% level. There was, however, a low bid/cover ratio as underlying demand was weak and the total raised was EUR7.0bn compared with an EUR8.5bn target which maintained underlying unease towards European bonds. There were particular concerns surrounding the heavy debt issuance in the first quarter of 2012 amid speculation over further underlying capital outflows. The latest ECB data did provide some reassurance with European banks net buyers of bonds in November and there will be some optimism that the central bank liquidity strategy is having some success.

The latest Euro-zone money supply data was weaker than expected as M3 growth slowed to 2.0% from 2.6% previously while loan growth also slowed sharply to 1.7% from 2.7% as monetary contraction continued within the peripheral economies. The German consumer inflation data did not have a significant impact with an annual figure of 2.3%. The overall implications are that monetary policy will need to be very expansionary in order to mitigate the worst of the Euro-zone crisis which will tend to limit underlying Euro support.

The US economic data was again mixed, but maintained the recent pattern of being slightly stronger than expected. While jobless claims increased to 381,000 in the latest week from 366,000 previously, there was a stronger than expected reading for the Chicago PMI index of 62.5 for December, little changed from November, while pending home sales rose 7.3% for the month which maintained yield support.

There was a further retreat in gold prices to a six-month low and further evidence of de-leveraging helped support the dollar. The Euro retreated to 15-month lows below 1.2870 before recovering back to the 1.2950 area in Asia on Friday as there was some technical respite.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to make a fresh attack on the 78 level against the yen on Thursday and, after a period of range trading, there was fresh selling pressure in Asia on Friday as the US currency retreated to test the 77.50 area.

The Japanese currency retained a strong tone on the crosses as the Euro retreated to 10-year lows as it tested the 100 level and Sterling also moved to below 120. There was further net capital repatriation which helped underpin the Japanese currency.

The latest PMI manufacturing index remained very fragile in historic terms, although it recorded a slight recovery to 50.2 for December from 49.1 previously. Markets will remain alert for Bank of Japan protests over yen strength.

Sterling

Sterling was blocked below 1.55 against the dollar on Thursday and subjected to fresh selling pressure later in the European session with a slide to fresh 11-week lows near 1.5360 as European currencies again lost out to the dollar. Sterling also retreated to beyond 0.84 against the Euro.

UK benchmark 10-year bond yields fell to a record low below 2.0% during the day which suggested there was still some defensive demand for UK assets.

Underlying confidence in the UK economy remained weak amid expectations that the Bank of England would consider further quantitative easing during the first quarter of 2012. There were also further concerns surrounding the banking sector which curbed demand for Sterling.

Swiss franc

The dollar pushed to highs around 0.9465 against the franc on Thursday, but it was unable to sustained the advance and retreated back to the 0.94 area. The Swiss currency retained a solid tone against the Euro as it advanced to near 1.2170.

There was inevitably caution surrounding the National Bank as thin liquidity would make it much easier for the bank to engineer a weaker currency. There will also be increasing reluctance to buy the franc if it approaches the 1.20 minimum Euro level. Markets will also be watching the inflation data early in 2012 to asses whether the deflationary threat has eased.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

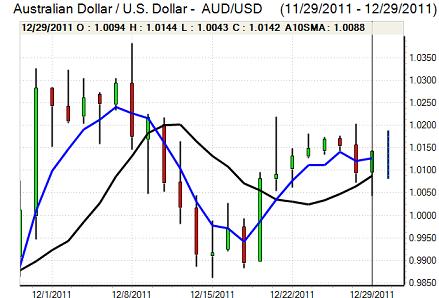

Australian dollar

The Australian dollar found support on dips to the 1.0050 area against the US currency on Thursday and rallied firmly to a peak near 1.0170 before losing momentum as the currency continued to challenge record highs against the Euro.

A rally on Wall Street helped improve risk appetite and also underpinned the Australian currency during the session. There was a small gain in private-sector credit which did not have a significant impact, although there were underlying concerns surrounding the housing sector as funds remained nervous over 2012 prospects.