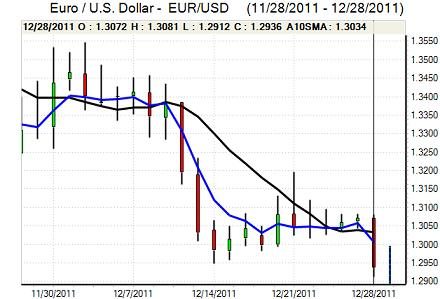

EUR/USD

The Euro initially edged marginally higher in Europe on Wednesday with the principal feature being very narrow ranges as trading volumes remained extremely low. There was a sharp decline in yields at the latest Italian Treasury Bill auction which helped underpin sentiment to some extent, although the impact was limited.

There were still important underlying fears surrounding the Euro-zone banking sector with banks depositing a record EUR452bn at the ECB. The sharp increase in deposits since the long-term repo operation last week increased speculation that there would be no underlying improvement in financing conditions as banks hoarded cash.

There was also a renewed increase in dollar Libor rates which suggested that there were still important market stresses and a dollar shortage which helped support the US currency.

The latest ECB balance sheet data recorded an increase to a record EUR2.73trn. Although expected, the increase helped to intensify speculation that there would be an underlying move to quantitative easing by the ECB even if it was effectively a forced move. A substantial dollar buy order against Sterling pushed the US currency stronger and was also important in triggering stop-loss Euro orders which pushed the currency sharply weaker.

There were no significant US developments during the day, but the US retained its yield advantage over German bunds which helped support the currency.

There was further selling once the 1.30 level broke and the Euro retreated to lows below 1.29 which was very close to 2011 intra-day lows seen in January. There was some consolidation in Asia on Thursday with the currency edging back to the 1.2930 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar drifted lower to the 77.60 area against the yen in Europe on Wednesday before rallying to the 78 area as the US currency advanced strongly against European currencies. There was still robust yen support on the crosses as it pushed to 11-year highs close to 100 against the Euro with Sterling also falling sharply.

Underlying risk appetite was still generally fragile amid unease over the global growth outlook which continued to trigger defensive flows into the Japanese currency as Japanese funds were reluctant to commit funds overseas.

The yen also continued to gain some support from the US Treasury report which criticised Bank of Japan intervention to weaken the yen. A lack of US support increases the probability that any future yen selling would be unilateral which would also limit its effectiveness.

Sterling

Sterling was unable to make a significant attack on resistance near 1.57 against the dollar on Wednesday and, after drifting around the 1.5640 area, it fell very rapidly during the New York session.

There were reports of a substantial Sterling sell order against the dollar which pushed it lower and triggered stop-loss selling as short-term funds accelerated the selling pressure in extremely thin trading conditions. There was also some evidence of corporate Euro buying against Sterling which helped pushed the UK currency weaker.

There were no major UK developments during the day, although there was survey evidence regarding the weak UK labour market which maintained concerns over the 2012 domestic outlook and had some negative Sterling impact.

Swiss franc

The dollar edged lower to the 0.9320 area against the franc on Wednesday before gaining sharply with highs near 0.9450 as the US currency advanced strongly against European majors. The Euro did find support close to 1.2180 against the franc, but was unable to make any progress significantly above 1.22.

The latest Swiss KOF business confidence index weakened to 0.01 for December from a revised 0.34 and was the lowest reading since August 2009. There has been a significant divergence over the past few months as German IFO confidence has held relatively firm while Swiss confidence has continued to deteriorate. There will be increased speculation that the Swiss economy is being damaged by competitiveness issues which will maintain pressure for the National Bank to engineer further franc weakening.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

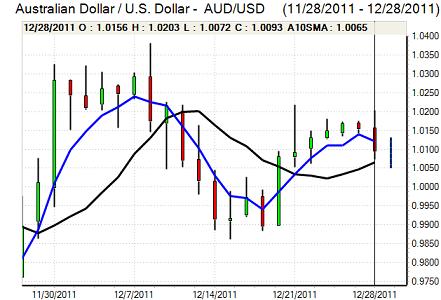

Australian dollar

The Australian dollar edged higher in European trading on Wednesday and briefly toughed the 1.02 level as stock markets advanced. There was a sharp reversal in New York trading as the US currency spiked sharply higher across the board and the Australian currency weakened to lows below 1.01 as commodity prices also retreated sharply. There was a temporary dip to 1.0050 before a technical recovery in Asia on Thursday.

In the absence of significant domestic developments, trends in risk appetite tended to dominate. From a 2012 perspective there were further concerns surrounding the Chinese economy which hampered Australian dollar sentiment.