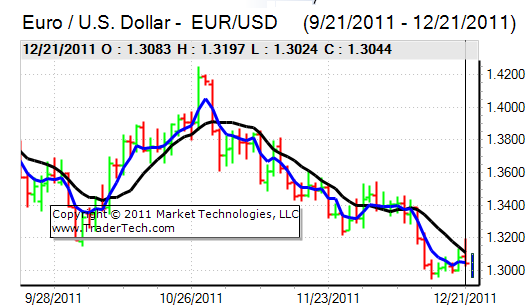

EUR/USD

After holding support in the 1.31 area in Europe on Wednesday, the Euro spiked higher following the ECB long-term repo operation. The central bank allocated a larger than expected EUR489bn in funds at the first 3-year tender with over 500 banks bidding for funds at 1.0%.

The huge allocation increased speculation that there would be an easing of the European credit crunch and that there would also be the potential for increased carry-trade buying of bonds.

The Euro failed to sustain the gains and weakened sharply back to below the 1.31 level. There was some disappointment over the bond-market reaction as Italian yields actually increased and the sheer size of the bidding also increased market fears over underlying vulnerability. There were fears that very tight credit conditions would undermine the potential for banks to use the funds and the fact that Italian banks used government-backed loans as collateral also maintained fears over system fragility.

There were also fresh rumours of a French credit-rating downgrade ahead of the US open while there were further tension surrounding Greek debt-restructuring talks. Markets overall were still doubtful whether the Euro-crisis could be eased and there was also increased speculation that the medium-term implications of any crisis Euro resolution would be a weaker currency.

The US existing home sales data was substantially weaker than expected with a decline to 4.42mn for November following a revised 4.25mn previously. There was a change in methodology with this release which triggered a sharp downward revision in sales. Overall, markets remained slightly more optimistic surrounding the US economy which helped maintain some yield support for the currency. The Euro dipped sharply to lows near 1.3025 against the dollar before nudging higher in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support in the 77.70 area against the yen on Wednesday and pushed higher to challenge resistance just above the 78 level during the Asian session on Thursday. Markets remained slightly more optimistic surrounding the US outlook which helped underpin the dollar.

A lack of liquidity will remain a key short-term feature and the low level of market activity will make it easier for the Bank of Japan and key Japanese funds to control the market. In this environment, there will be a reluctance to sell the dollar aggressively.

There were still underlying fears surrounding the regional economy with China an inevitable focus as equity markets sank to 2011 lows. Unease surrounding the growth outlook will continue to limit potential capital outflows from the yen.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Sterling

Sterling maintained a strong tone in the European session on Wednesday and pushed to a high around 1.5770 against the dollar, equalling highs seen in December. A rapid recovery in the dollar pulled Sterling from its highs and it retreated back to below 1.57. The UK currency held very firm against the Euro, however, and advanced to an 11-month high near 0.83.

The Bank of England minutes from December’s MPC meeting were broadly in with expectations as there were 9-0 votes for leaving interest rates and quantitative easing on hold. There were further concerns over the economic outlook and the possibility of further action following the end of the existing programme was discussed again.

The latest government borrowing data was again slightly better than expected with a net borrowing requirement of GBP15.2bn for November from a revised GBP3.0bn the previous month with a small annual decline. Markets were still wary of the economy and public finances being blown off course by Euro-zone turbulence and confidence in the housing sector remained weak.

Swiss franc

The dollar initially remained under pressure against the franc on Wednesday and dipped to test support near 0.9250, but it then recovered strongly and briefly hit the 0.94 level as the Euro also regained the 1.22 level.

The Swiss government continued their debate on additional measures to weaken the franc. Parliament rejected negative interest rates, at least in the short term, but raising the Euro minimum level remained under consideration. The threat of National Bank action will continue to be effective in stemming franc demand, especially with low liquidity. The huge repo operation to Euro-area banks will also tend to lessen the potential for defensive inflows into the franc.

Australian dollar

The Australian dollar advanced strongly during the European session on Wednesday and pushed to a high above the 1.02 level against the US dollar. There was an equally sharp descent with a retreat to lows around 1.0050 before fresh buying support emerged.

There were underlying doubts surrounding the Chinese economy which dampened demand for the currency and further speculation of longer-term outflows from the Australian dollar. International credit ratings remained an important influence and there was still some underlying currency demand related to the fact that Australia retains its AAA credit rating.